Finding the right senior medical insurance options can feel challenging, but understanding your choices can make all the difference. This guide highlights the best affordable health insurance plans available in 2025, including Medicare, Medigap, and other essential coverage options, helping you choose a plan that fits your needs.

Key Takeaways

- Wide Range of Coverage Options: Seniors in 2025 can explore various health insurance plans, including Medicare, Medigap, long-term care insurance, and more. Taking the time to evaluate your specific health needs and financial situation is essential for selecting the right plan.

- Travel Insurance for Peace of Mind: Medicare does not cover medical expenses outside the U.S., so seniors planning to travel should consider travel insurance to safeguard against unexpected healthcare costs and evacuation fees.

- Understanding Plan Differences: Knowing the distinctions between Medicare Advantage Plans, Medigap policies, and standalone vision and dental plans can help you make informed decisions about your healthcare coverage.

Top Affordable Senior Medical Insurance Options for 2025

As of 2025, seniors have access to a variety of national health insurance programs designed to meet their unique needs. These include:

- Health insurance

- Dental coverage

- Life insurance

- Long-term disability coverage

Assessing personal health needs and financial capacity is essential when choosing a plan. The right medical insurance can protect seniors from unexpected healthcare expenses while ensuring access to necessary services.

Don’t Overlook Travel Insurance

Travel insurance is crucial for seniors who plan to visit destinations outside the United States. Medicare does not cover medical expenses incurred abroad, so securing travel insurance safeguards against emergency healthcare costs and evacuation fees. This applies even for trips to nearby countries like Canada or Mexico.

Medicare Overview

Medicare is a national health insurance program primarily serving older adults and individuals under 65 with certain disabilities. It is important to understand the components of Medicare to make informed decisions about coverage.

Original Medicare (Parts A & B)

Original Medicare includes:

1) Part A (Hospital Insurance):

Covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care. Most individuals qualify for premium-free Part A if they’ve paid Medicare taxes for at least ten years. However, costs such as the $1,676 deductible per hospital admission in 2025 still apply.

2) Part B (Medical Insurance):

Covers outpatient care, preventive services, ambulance services, and durable medical equipment. In 2025, the monthly premium is $185, and the annual deductible is $257. Once the deductible is met, beneficiaries typically pay 20% of the cost for each covered service.

Understanding these costs and coverages can help seniors plan and budget for their healthcare needs effectively.

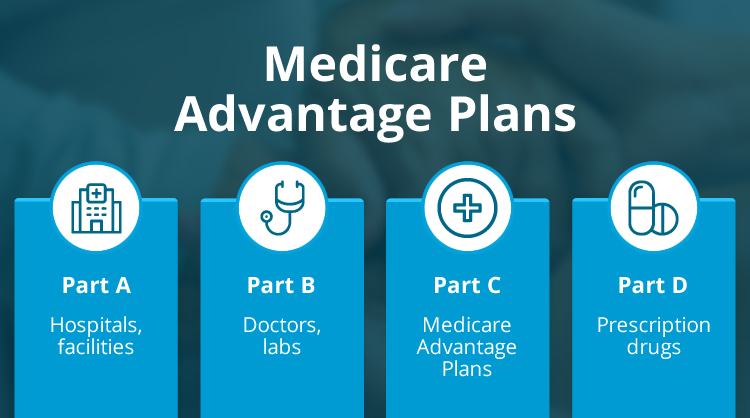

Medicare Advantage Plans (Part C)

Medicare Advantage Plans, also known as Part C, offer an alternative to Original Medicare. These plans are provided by private insurance companies approved by Medicare and combine coverage from Part A and Part B, often including additional benefits such as:

- Prescription drug coverage

- Vision and dental services

- Wellness programs

Medicare Advantage Plans typically require enrollees to use a network of providers and may need referrals for specialist visits. Given that costs and coverage vary by location, it is vital to compare plans carefully to ensure they align with individual health needs.

Medicare Part D – Prescription Drug Coverage

Medicare Part D is an optional program that helps cover the cost of outpatient prescription drugs. It is especially important for seniors managing chronic conditions to ensure access to necessary medications. Administered by private insurance companies, these plans must include a minimum number of drugs in each treatment category to meet regulatory requirements.

In 2025, fewer stand-alone Part D plans will be available, making it crucial for beneficiaries to review their options thoroughly. Key factors to consider include:

- Premiums

- Deductibles

- Coverage limits

By understanding these elements, seniors can select a prescription drug plan that fits their specific needs and budget effectively.

Medigap Policies

Medigap policies, also known as Medicare Supplement Insurance, help cover costs that Original Medicare does not, such as copayments, coinsurance, and deductibles. To be eligible for Medigap, you must be enrolled in Medicare Part A and Part B. The six-month Medigap Open Enrollment Period begins when you enroll in Part B, allowing you to purchase any eligible Medigap policy in your state without medical underwriting.

If you switch from a Medicare Advantage Plan to Original Medicare, you may apply for a Medigap policy during specific timeframes. However, Medigap coverage is not available to individuals currently enrolled in a Medicare Advantage Plan.

Several factors influence Medigap premiums, including:

- Age

- Gender

- Marital status

- Income level

- Location

- Smoking status

Understanding these factors can help you choose the right Medigap policy to fit your healthcare and financial needs.

Long-Term Care Insurance

Long-term care insurance provides coverage for extended health care services in settings such as assisted living facilities and nursing homes. This type of coverage is vital, as approximately 70% of people turning 65 after 2020 are expected to require long-term care services. The projected annual cost of a private room in a nursing home in 2025 is $120,304, making long-term care insurance a crucial investment.

The cost of long-term care insurance varies depending on factors such as:

- Age

- Health status

- Gender

- Policy features (e.g., inflation protection, elimination periods)

Premiums tend to increase with age, so purchasing a policy in your mid-50s can be more economical. Long-term care insurance ensures access to necessary services while protecting your savings from significant healthcare expenses.

Vision and Dental Insurance

Maintaining good dental health is essential for seniors, as conditions such as tooth decay and gum disease can significantly affect overall well-being. Unfortunately, regular dental services like exams and preventative care are not included in traditional Medicare coverage.

Vision insurance plans cover critical procedures such as routine eye exams and prescription eyewear, which are also excluded from standard Medicare coverage. Separate insurance plans for vision and dental provide seniors with access to essentials, including:

- Glasses

- Contact lenses

- Standard dental visits

Seniors have the flexibility to select policies tailored to their specific vision and dental care needs, as well as their financial circumstances. A wide range of plan options—from budget-friendly to premium—allows seniors to find coverage that aligns with their requirements.

Life Insurance Options for Seniors

Life insurance provides financial security for the loved ones of older adults. Seniors can choose from two primary types of life insurance:

- Term Life Insurance: Offers protection for a specific period, typically with lower premiums.

- Whole Life Insurance: Provides lifelong coverage and includes a savings component that grows over time.

The cost of life insurance premiums depends on several factors, including:

- Policy type

- Health conditions

- Age

- Consistency in premium payments

By understanding these factors, seniors can make informed decisions about their life insurance needs. Choosing the right policy ensures financial security for their families and peace of mind for themselves

Auto Insurance for Seniors

Seniors should pay close attention to their auto insurance needs to ensure they receive the best coverage at the most competitive rates. Remaining with the same insurer for many years can sometimes lead to higher premiums. Regularly comparing rates from other providers can help older adults find better deals. Changes in driving habits, such as reduced mileage, can also lower insurance costs.

Before selecting a policy, seniors must confirm they meet their state’s minimum auto insurance requirements. Research suggests that today’s elderly drivers are involved in fewer accidents than previous generations, a trend that could positively impact their insurance rates. By evaluating these factors, seniors can secure optimal coverage that aligns with their budget.

Travel Insurance for Seniors

Travel insurance is indispensable for seniors, especially since Medicare does not cover medical expenses incurred abroad. These plans offer protection against emergency healthcare costs, evacuation fees, and sometimes even sports or hazardous activities—a valuable feature for seniors with active lifestyles. Policies are typically available for trips ranging from 5 to 364 days of single-trip coverage.

To determine whether their Medicare plan includes foreign travel emergency health care benefits, seniors can use Medicare’s 24/7 chat service or contact them directly. Choosing the right travel insurance policy provides peace of mind, allowing seniors to enjoy their journeys without worrying about unexpected medical expenses.

Additional Resources for Different Types of Insurance

Seniors can improve their decision-making process regarding insurance options by utilizing available resources. For instance, the Healthy Aging Program offered by Atlantic Health System provides vital information and support for Medicare, Medicaid, and long-term care insurance. This program helps seniors explore and understand their coverage options.

By engaging with such resources and organizations, seniors can identify the most suitable insurance coverage to meet their needs while safeguarding their financial stability.

Summary

It is essential for seniors to understand the wide range of insurance options available in 2025. This knowledge is crucial for selecting healthcare coverage that fits their needs. From Medicare and supplemental Medigap policies to long-term care and travel insurance, each option provides distinct benefits tailored for protection and peace of mind.

By carefully evaluating their health requirements and financial situation, seniors can secure comprehensive coverage that ensures access to necessary services while managing costs effectively. Leveraging the insights shared in this guide can help seniors protect their health and financial well-being.

Seniors are encouraged to explore all available resources and seek advice from trusted insurance experts to identify plans that align with their specific needs. With the right coverage in place, seniors can confidently face the future, knowing they are prepared for potential challenges.

Frequently Asked Questions

1. What is the difference between Original Medicare and Medicare Advantage Plans?

Original Medicare consists of Part A (hospital insurance) and Part B (medical insurance), providing foundational coverage. Medicare Advantage Plans, offered by private insurers, bundle these benefits and often include additional services such as vision, dental, and prescription drug coverage. Medicare Advantage is an excellent choice for those seeking more comprehensive benefits.

2. Why is long-term care insurance important for seniors?

Long-term care insurance is essential for covering the sustained costs of health care in settings like nursing homes and assisted living facilities. Approximately 70% of people over 65 will require long-term care at some point. This type of insurance helps ease financial burdens and ensures access to necessary services, offering seniors financial stability and peace of mind.

3. What does Medicare Part D cover?

Medicare Part D covers outpatient prescription drugs and assists with their costs through private insurance companies. It is a voluntary program with specific coverage requirements, ensuring seniors have access to essential medications.

4. How can seniors lower their auto insurance premiums?

Seniors can lower their auto insurance premiums by:

- Comparing rates from multiple insurers.

- Assessing their driving habits and reducing mileage.

- Opting for state-required minimum coverage levels.

- Maintaining a clean driving record.

These strategies can help seniors secure affordable auto insurance.

5. Are vision and dental services covered by Medicare?

Routine vision and dental services are not covered by Medicare. However, standalone plans and Medicare Advantage Plans often include these benefits. Exploring additional coverage options is advisable to ensure access to essential vision and dental care services.

6. What are the best affordable health insurance options for seniors in 2025?

Seniors can choose from a range of affordable options, including Medicare, Medicare Advantage Plans, Medigap policies, and standalone vision and dental plans. Each option provides unique benefits, so it’s essential to assess your health needs and budget.

7. Does Medicare cover international travel?

No, Medicare does not cover medical costs incurred outside the U.S. Seniors planning international trips should consider travel insurance to protect against unforeseen expenses like medical emergencies or evacuation costs.

8. What factors affect Medigap premiums?

Medigap premiums depend on factors such as age, gender, location, health status, and smoking habits. Comparing plans during the six-month Medigap Open Enrollment Period can help secure the best rates.

9. Can seniors get dental and vision insurance with Medicare?

Traditional Medicare does not cover routine dental and vision care. However, Medicare Advantage Plans and standalone policies are available to provide this coverage.

10. How do Medicare Advantage Plans differ from Medigap policies?

Medicare Advantage Plans provide an all-in-one alternative to Original Medicare, bundling coverage for hospital, medical, and often prescription drugs. Medigap policies supplement Original Medicare by covering out-of-pocket costs like deductibles and coinsurance.