Comparing medical insurance plans can be simple when you know how to compare medical insurance plans effectively. This guide will help you understand costs, coverage, and plan networks to find the best plan for your needs.

Key Takeaways

- Gather comprehensive plan information, including covered services, costs, and key insurance terms before comparing health insurance plans.

- Understand your healthcare needs by reflecting on past expenses and anticipating future health events to select a suitable insurance plan.

- Compare different plan types and costs, considering factors such as in-network provider availability, prescription drug coverage, and additional benefits to make an informed choice.

Gather Essential Plan Information

Before exploring different health insurance plans, start by gathering essential plan information. Investigate covered services to understand what each health insurance plan offers. This includes details about coverage for regular and necessary care like prescriptions and specialists. Familiarizing yourself with key insurance terms such as premiums, deductibles, and out-of-pocket costs will help you understand the cost implications and make more informed decisions.

Utilize resources such as your employer’s HR department and online tools for information. Don’t hesitate to ask your workplace benefits administrator for specific documents related to your plan.

The Summary of Benefits and Coverage (SBC or SOB) offers a detailed overview of your health plan. This foundational step provides a solid understanding of each plan before comparing options.

Understand Your Healthcare Needs

The next step in choosing the right health insurance plan is evaluating your healthcare needs. This means looking at both your past medical expenses and any expected health events in the coming year. By understanding your medical history and anticipating future care, you can select a plan that provides the right balance of coverage for prescriptions, specialist visits, and necessary treatments.

Evaluate Past Medical Expenses

Reviewing your past medical expenses is an important step in choosing the right health insurance plan. Looking at previous healthcare costs helps you identify spending patterns and anticipate future medical needs. By analyzing past expenses, you can determine whether your current coverage was sufficient or if you might need a plan with better benefits.

Some health plans offer stronger coverage for services like physical therapy, fertility treatments, mental health care, and emergency visits than others. Understanding which services you’ve used frequently can guide you in selecting a plan that provides the right balance of premiums, deductibles, and out-of-pocket costs. This foresight can help you avoid unexpected medical expenses and ensure you have the coverage you need.

Consider Upcoming Health Events

Review any planned preventive care appointments, such as annual check-ups or screenings, for the upcoming year. Being aware of potential health events can guide your decisions about necessary insurance coverage adjustments. For example, If you anticipate needing a specific procedure or treatment, make sure your health plan covers those services to avoid surprise costs.

Additionally, consider lifestyle changes that might impact your health needs, such as starting a new exercise routine, expanding your family, or managing a chronic condition. Choosing a plan that adapts to these changes ensures you stay covered and financially protected throughout the year.

Compare Plan Types

Before:

With a clear understanding of your healthcare needs, compare different types of health insurance plans. The common types of health insurance plans include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and Point of Service (POS) plans. Each type of plan has distinct rules regarding provider networks and costs.

After:

Each type of plan has distinct rules regarding provider networks and costs.

Knowing the differences between these plan types is crucial for making an informed decision. HMO and POS plans often require referrals for specialists, while EPO and PPO plans usually allow members to see specialists without a referral.

Next, explore the specifics of HMO and PPO plans, as well as High Deductible Health Plans (HDHP) with Health Savings Accounts (HSA).

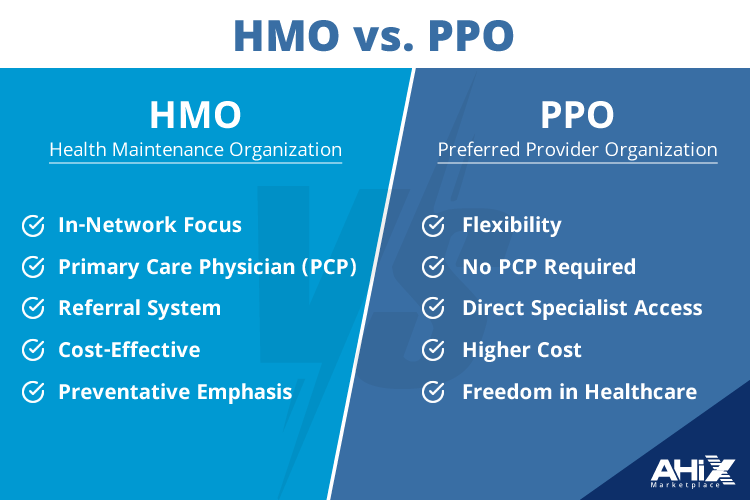

Health Maintenance Organization (HMO) vs. Preferred Provider Organization (PPO)

Health Maintenance Organization (HMO) plans require members to stay in-network for most services, except in emergencies. This means you’ll need to select a primary care physician (PCP) who coordinates your care and refers you to specialists. HMO plans are generally cheaper compared to other types of health plans.

Preferred Provider Organization (PPO) plans offer more flexibility, allowing members to choose providers outside their network without restrictions. PPO plans do not require referrals to see specialists, providing greater freedom in accessing healthcare services.

These differences can help you decide which type of plan best suits your healthcare needs and preferences.

High Deductible Health Plans (HDHP) with Health Savings Accounts (HSA)

High Deductible Health Plans (HDHPs) are characterized by lower premiums, higher upfront costs, and higher deductibles. These plans often pair with Health Savings Accounts (HSAs), allowing you to save for medical costs using pretax money. HSAs can be used in conjunction with HDHPs, allowing funds to roll over year after year.

Employers have the option to contribute to employee Health Savings Accounts (HSAs). This serves as an incentive for employees to choose High Deductible Health Plans (HDHPs). When you leave your job, the money in your HSA is yours to keep and can roll over from year to year. Knowing the financial benefits and potential drawbacks of HDHPs and HSAs can guide you in deciding if this type of plan is right for you.

Check Plan Networks

Verifying the plan’s network is crucial in selecting the right health insurance plan. Ensure to check the network of a new health insurance plan to see which doctors are available and save time when needing care. Costs are generally lower with in-network doctors due to negotiated rates with providers. Search each plan’s provider network for primary care providers, hospital services, and specialists to ensure adequate coverage.

If open to seeing a new primary doctor, explore future network options before enrollment. Use a provider search tool to find clinics and network providers conveniently.

Checking your health plan’s network can help you avoid unforeseen expenses related to out-of-network care and ensure access to required healthcare providers.

In-Network Doctor Availability

To maintain your current doctor, verify their status in the new health plan’s network. Network providers consent to provide care for plan members. They do so at a discounted rate. This can significantly reduce your medical costs and ensure continuity of care.

When searching for a new health insurance plan, explore a wide network for more choices, especially in rural areas. Verifying the availability of in-network doctors ensures your healthcare needs are met without incurring additional costs.

Access to Specialists and Facilities

Access to specialists and facilities is another critical aspect to consider when choosing the best health insurance plan. Certain health plans may offer varying levels of coverage for specialized services like mental health care and fertility treatments. Having access to the necessary specialists and facilities can significantly improve your healthcare experience.

If you require regular specialist visits or access to specific medical facilities, ensure these are covered under your chosen plan. This ensures you receive specialized care without facing unexpected medical costs.

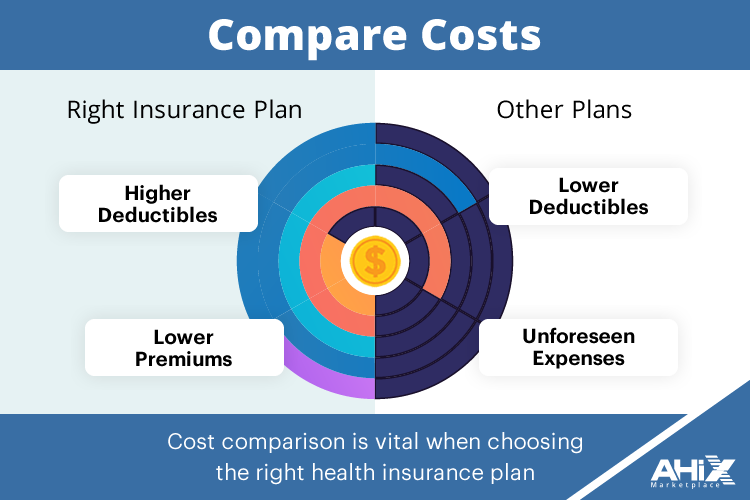

Compare Costs

Cost comparison is vital when choosing the right health insurance plan. Lower premiums usually mean higher deductibles, while higher premiums typically result in lower deductibles. Evaluating different plans helps determine overall lower out-of-pocket costs. Knowing the specifics of your plan’s network helps avoid unforeseen expenses related to out-of-network care.

When comparing costs, review the plan’s cost summary of benefits for detailed service and prescription costs. This helps you understand the full scope of potential medical costs and make an informed decision.

Higher Monthly Premiums vs. Lower Deductibles

Plans with higher monthly payments often come with lower out-of-pocket expenses overall. A common comparison when considering health insurance is between plans with higher monthly premiums and lower deductibles. Lower out-of-pocket expenses can mitigate the financial impact of unexpected medical costs, making higher plan’s premium plans attractive to some consumers.

Choosing higher premiums often guarantees savings on deductibles, which can be a smart choice if you anticipate frequent medical care. This trade-off can provide peace of mind and financial stability.

Lower Premiums vs. Higher Out-of-Pocket Costs

Choosing a plan with reduced premiums can lead to significant savings if healthcare needs are minimal. This option is ideal for individuals who do not anticipate frequent medical care and are comfortable with higher out-of-pocket costs in case of emergencies.

Understanding the trade-off between lower premiums and higher out-of-pocket costs helps you choose a plan that aligns with your financial situation and healthcare needs. This approach can help you save money while ensuring you have adequate coverage for unexpected medical events, including your out of pocket maximum.

Review Prescription Drug Coverage

Reviewing prescription drug coverage ensures that your medications are included in the health plan’s formulary. Checking coverage details, supply limits, and potential savings with generics can result in significant cost savings. Comparing costs between generic and brand-name drugs can save money on prescriptions.

Seek opportunities to switch to generics for cost savings. This ensures that your prescription needs are met without incurring excessive costs.

Pharmacy Network and Mail-Order Options

Exploring in-network pharmacies maximizes your prescription benefits. In-network pharmacies often provide medications at a lower cost, ensuring that you get the most out of your health plan.

Mail-order pharmacies offer convenience and cost savings for regular medications. Utilizing mail-order options ensures you always have necessary medications on hand without frequent trips to the pharmacy.

Additional Perks and Benefits

Modern health plans often include extra benefits designed to support overall wellness, such as:

- Wellness programs and fitness discounts.

- Smoking cessation support.

- Mental health resources.

- Virtual care and telemedicine options.

These value-added benefits can enhance your healthcare experience while promoting healthier living habits.

Utilize Employer Resources and Tools

If your employer offers health insurance, take advantage of available resources like enrollment guides, informational sessions, and access to HR representatives.

Additionally, ask about health-related accounts, such as:

- Flexible Spending Accounts (FSAs)

- Health Reimbursement Arrangements (HRAs)

- Health Savings Accounts (HSAs)

Summary

In summary, selecting the right health insurance plan involves gathering essential information, understanding your healthcare needs, comparing different plan types, checking plan networks, reviewing costs, and evaluating additional perks and benefits. By following this step-by-step guide, you can make an informed decision that meets your healthcare needs and budget.

Remember, the right health insurance plan can provide peace of mind and ensure that you have access to the necessary medical care. Take the time to evaluate your options carefully and choose a plan that offers the best coverage for you and your family.

Frequently Asked Questions

1. How do I determine which health insurance plan is best for me?

To determine the best health insurance plan for you, gather essential plan information, assess your healthcare needs, and compare costs, network coverage, and prescription drug options. Consider utilizing employer resources for a more informed decision.

2. What should I look for in a health insurance plan’s network?

Look for a health insurance plan that includes your preferred doctors and specialists in its network, as this will help minimize your medical costs. Additionally, ensure that there are sufficient primary care providers and hospital services available for comprehensive coverage.

3. How can I save on prescription drug costs?

To save on prescription drug costs, review your plan’s formulary to ensure your medications are included, and compare the costs of generic versus brand-name drugs. Additionally, consider using mail-order options for added convenience and potential savings.

4. What are the benefits of wellness programs in health insurance plans?

Wellness programs in health insurance plans promote healthier living and help prevent chronic diseases by offering resources such as fitness incentives, mental health support, and nutrition counseling. This comprehensive approach not only improves overall health but can also reduce healthcare costs for both insurers and policyholders.

5. How can I use my employer’s resources to choose the right health insurance plan?

You can effectively choose the right health insurance plan by utilizing enrollment guides, benefits presentations, and health-related accounts such as FSA, HRA, and HSA offered by your employer. Engaging with your HR department or Member Services will also provide valuable assistance in understanding your options.