Top Scenarios That Qualify You for Special Enrollment Periods

Last modified on April 18th, 2025

Special Enrollment Periods (SEPs) allow you to sign up for health insurance outside of the regular Open Enrollment period if you experience a major life event — like getting married, having a baby, losing your job, or moving. You typically have 60 days after the qualifying life event (QLE) to enroll. If you miss that …

Who Is Not Eligible for Obamacare? Eligibility Rules & Alternative Health Plans

April 3, 2025

The Affordable Care Act (ACA), commonly known as Obamacare, was created to expand access to health insurance for millions of Americans. But who is not eligible for Obamacare? Certain groups—such as non-residents, incarcerated individuals, undocumented immigrants, and Medicare beneficiaries—do not qualify for ACA marketplace plans. This guide explains why these groups are excluded and explores …

Best Health Insurance for Low Income Residents in Michigan

March 13, 2025

Are you a low-income resident looking for health insurance in Michigan? If so, there are several programs that can help. Michigan offers Medicaid, the Healthy Michigan Plan, and the Children’s Health Insurance Program (CHIP), each designed to provide affordable health coverage. This article helps you determine your eligibility, understand the benefits, and navigate the application …

Obamacare vs. Medicare: Understanding the Differences and Benefits

Last modified on March 4th, 2025

Introduction Choosing the right health insurance plan is a crucial decision, especially with multiple options available in the United States. Two of the most well-known programs, Obamacare (Affordable Care Act – ACA) and Medicare, serve different populations with distinct benefits, costs, and eligibility requirements. Obamacare is designed for individuals and families, particularly those under 65 …

How to Compare Medical Insurance Plans: A Step-by-Step Guide

March 3, 2025

Comparing medical insurance plans can be simple when you know how to compare medical insurance plans effectively. This guide will help you understand costs, coverage, and plan networks to find the best plan for your needs. Key Takeaways Gather comprehensive plan information, including covered services, costs, and key insurance terms before comparing health insurance plans. …

What to Do if Your Health Insurance Claim Is Denied?

Last modified on February 17th, 2025

You pay for health insurance to protect yourself from high medical costs, but what happens when your health insurance claim gets denied? It’s frustrating, confusing, and honestly, it can feel unfair. You might wonder, “Now what? Do I have to pay this entire bill myself?” Take a deep breath, a denied claim does not mean …

Best Health Insurance for Kids: Compare Plans & Costs (2025 Guide)

Last modified on February 28th, 2025

Finding health insurance for kids can be challenging, but it’s essential to ensure they receive the best care. This guide covers everything you need to know about different health insurance options for children, helping you choose the right plan and secure their health and well-being. Key Takeaways Health insurance is essential for children as it …

How to Choose the Best Emergency Health Care Insurance for Your Family

Last modified on January 29th, 2025

Choosing the right emergency health care insurance for your family is one of the most important decisions you can make. Emergencies can happen at any time, whether it’s a sudden illness, an unexpected injury, or an accident. Having the right health insurance coverage ensures that you’re protected in these critical moments without facing high medical …

How Does the Florida Obamacare Health Insurance Marketplace Work?

January 24, 2025

The Affordable Care Act (ACA), often referred to as Obamacare, has made it easier for millions of Floridians to find affordable, high-quality health insurance. As part of this initiative, the AHiX marketplace in Florida offers an accessible platform for individuals and families to explore their health insurance options. In this blog, we will walk you …

What is the Best Medicaid Plans in South Carolina?

Last modified on April 18th, 2025

Curious about what is the best Medicaid plan in South Carolina? This blog will compare the top options, explain their benefits, and help you choose the right plan for your healthcare needs. Key Takeaways Medicaid in South Carolina provides essential healthcare coverage for low-income individuals and families, helping manage health costs. When choosing a Medicaid …

South Carolina Temporary Health Insurance: All You Need to Know!

Last modified on January 20th, 2025

If you’re living in South Carolina and need health insurance for a short period of time, temporary health insurance might be the right option for you. This type of coverage is designed for individuals who need insurance for a limited duration, such as those transitioning between jobs or waiting for another policy to begin. While …

Top Affordable Senior Medical Insurance Options for 2025

Last modified on January 23rd, 2025

Finding the right senior medical insurance options can feel challenging, but understanding your choices can make all the difference. This guide highlights the best affordable health insurance plans available in 2025, including Medicare, Medigap, and other essential coverage options, helping you choose a plan that fits your needs. Key Takeaways Wide Range of Coverage Options: …

What Is a Qualified Health Plan (QHP)? Comprehensive Guide to ACA Benefits

Last modified on January 20th, 2025

Essential Facts About Qualified Health Plans Are you looking for a reliable health insurance policy that covers all your essential health needs? A Qualified Health Plan (QHP) could be just what you need. These plans are designed to meet the Affordable Care Act (ACA) standards, which means they offer comprehensive coverage for important services like …

How to Pick the Best Idaho Medical Insurance Plan for 2025-26

Last modified on January 20th, 2025

When choosing the right Idaho medical insurance plan for 2024- 25, it’s crucial to evaluate both your healthcare needs and budget. This blog will take you through the process of picking the best Medical Insurance options, focusing on various types of plans available through the Idaho Medical Insurance Exchange and other marketplaces like AHiX. 1. …

Why Investing in Family Health Insurance Plans is Worth Buying ?

Last modified on January 20th, 2025

In today’s world, having health insurance for your family is very important. Family health insurance plans help cover medical costs and make sure everyone gets the care they need. This blog will explain why you should buy health insurance for your family, how to choose the right and affordable plan, what it covers, and the …

Affordable Arizona Dental Insurance Coverage for Individuals & Families

Last modified on January 20th, 2025

Searching for Arizona dental insurance coverage? This guide helps you find and choose the right plan. Learn your options, key features, and how to enroll. Key Takeaways Dental insurance in Arizona provides essential coverage for preventive and major treatments, with options available as part of health plans or standalone policies. When selecting a dental plan, …

Do You Need a Dental Insurance Plan? Know Why and How to Get Covered!

Last modified on January 20th, 2025

Dental insurance plans are often a dismissed part of health care coverage, but it plays a major role in maintaining your overall well-being. Many people wonder, “Is dental insurance really necessary?” The answer may vary depending on individual needs and circumstances. While dental treatments can be expensive and financially exhausting without coverage, not everyone may …

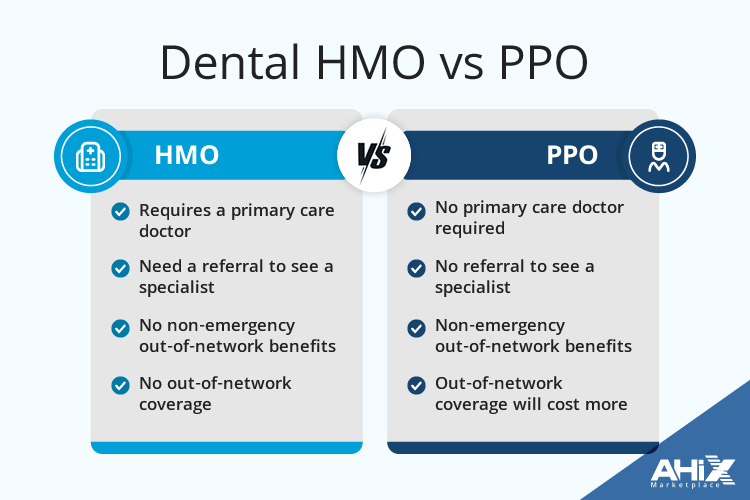

Difference Between Dental HMO vs PPO: Choosing the Best Plan for You

Last modified on January 20th, 2025

Are you deciding between Dental HMO vs PPO plans? Our guide will help you compare costs, coverage, and provider choices, so you can find the best plan for your needs. Key Takeaways DHMO plans offer lower premiums and predictable costs but require members to select a primary care dentist from a limited network, restricting provider …

Understanding Dental Insurance: What Does It Really Cover?

Last modified on January 20th, 2025

What Is Dental Insurance? Dental insurance is a type of health insurance that helps cover the cost of dental care, including preventive services like cleanings and exams, as well as procedures like fillings and crowns. It reduces out-of-pocket expenses by sharing costs between you and the insurance provider, providing a significant dental benefit. Understanding dental …

2024 Rule Update: Short Term Limited Duration Insurance Limited to 4 Months

Last modified on January 21st, 2025

The health insurance landscape constantly evolves, and with the new rule that took effect on September 1st, 2024, significant changes have impacted short-term health insurance plans. This update, which limits short term limited duration insurance to a maximum of four months, is one everyone needs to know. Whether you’re currently covered by a short-term plan …

10 Key Benefits of ACA Plans and Clearing Up Misconceptions

Last modified on January 21st, 2025

What Are ACA Plans? ACA plans, also referred to as Affordable Care Act policies or “Obamacare” health plans, are designed to provide affordable and comprehensive healthcare coverage. These health insurance options were established to ensure that all Americans have access to quality medical care. Affordable Care Act plans cover a wide range of medical services, …

2025 Guide to Individual Health Insurance in Arizona: Enrollment Tips and Options

Last modified on January 21st, 2025

Health insurance is a crucial part of managing your healthcare and financial well-being. With open enrollment 2025 just around the corner, it’s the perfect time to familiarize yourself with the process of securing individual health insurance in Arizona. Whether you’re new to the state or looking to switch plans, this guide will walk you through …

Understanding Temporary Health Insurance in Arizona

Last modified on January 21st, 2025

Arizona Temporary health insurance, also known as short-term health insurance, can be an essential solution for many Arizonans who find themselves without traditional health insurance coverage. Whether you are between jobs, waiting for your employer’s benefits to kick in, or just needing coverage for a short period, understanding temporary insurance is crucial. its benefits, limitations, …

Ultimate Guide to Arizona Senior Health Insurance Plans

Last modified on March 20th, 2025

Arizona Senior Health Insurance Plans play a crucial role in ensuring seniors have access to the medical care they need. As we age, health insurance becomes increasingly important, especially for seniors who may require more medical attention and services. Navigating the many healthcare coverage options in Arizona can feel overwhelming. This comprehensive guide will help …

How to Choose a Health Insurance Plan in Arizona

Last modified on August 13th, 2024

Choosing the right health insurance plan can be a life-changing decision, especially in Arizona where healthcare options are vast and varied. The right plan can ensure you and your family have access to essential healthcare services without breaking the bank. In this guide, we’ll explore the different types of health insurance plans available in Arizona, …

2025 Health Plan Cost-Sharing Limits: Key Updates

Last modified on August 13th, 2024

As we approach 2025, staying informed about changes in health plan cost-sharing requirements, including Health Savings Account (HSA) plans, is crucial. Recent updates provide important details that affect both individual policies and group health plans. Here’s what you need to know to stay ahead: What Are Cost-Sharing Limits? Cost-sharing limits are the maximum amounts you …

Types of Health Insurance Coverage in Arizona

Last modified on January 21st, 2025

Health insurance is vital for accessing quality healthcare and protecting against rising medical costs. In Arizona, residents have various options when it comes to health insurance coverage, each with its own set of benefits and considerations. Introduction to Health Insurance in Arizona Arizona offers a diverse selection of health insurance plans tailored to meet the …

The Ultimate Guide to Securing Top Family Health Insurance in Arizona

Last modified on August 13th, 2024

Choosing the right family health insurance in Arizona is crucial for keeping your family safe and financially sound. Understanding the benefits of family health insurance helps you sift through different plans to find one that best fits your family’s needs. This type of insurance does more than cover medical bills; it brings peace of mind …

Top Arizona PPO Plans: Affordable Health Insurance Options for 2025

Last modified on April 10th, 2025

Wondering about your PPO health insurance options in Arizona? This guide breaks down the top Arizona PPO plans, including providers, costs, and what you can expect from each plan. Key Takeaways PPO plans in Arizona provide flexibility to choose healthcare providers without referrals, making them suitable for those who value autonomy in their healthcare decisions. …

What Is Open Enrollment? Definition & Meaning

Last modified on August 13th, 2024

Navigating Open Enrollment can be crucial for anyone looking to secure or adjust their health insurance coverage. This guide breaks down everything you need to know about this important period, from key dates and eligibility requirements to tips for smoothly managing the enrollment process. Whether you are enrolling for the first time or updating your …

The Ultimate Guide to Selecting the Best Health Insurance Plan

Last modified on April 3rd, 2025

Selecting the best health insurance plan is vital for your health and financial stability. In this guide, we’ll outline seven clear steps to help you through the selection process. From assessing your healthcare needs to exploring additional health benefits elsewhere, these insights will guide you toward a plan that perfectly suits your lifestyle and budget. …

What Are Health Insurance Marketplaces?

Last modified on August 13th, 2024

In today’s dynamic healthcare landscape, navigating the realm of health insurance can be overwhelming. With various options available, understanding where to find the right coverage can make a significant difference. Enter health insurance marketplaces – a pivotal resource designed to simplify the process of securing health insurance plans tailored to individual needs. Understanding Health Insurance …

What is Obamacare? Everything You Need to Know

Last modified on August 13th, 2024

“What is Obamacare?” Obamacare, also known as the Affordable Care Act (ACA), is a crucial law in the United States designed to make health insurance more accessible and affordable for more people. It introduces various rules and programs to help achieve this goal. This law significantly impacts millions of Americans by providing them with health …

Best Options to Compare Private Health Insurance Cost for Individuals & Families

Last modified on October 3rd, 2024

Wondering about private health insurance cost? This article covers essential factors influencing premiums, deductibles, and out-of-pocket expenses. We’ll also provide tips on how to compare plans to find the best fit for your needs and budget. Read on to navigate these costs effectively. Key Takeaways Private health insurance costs vary significantly based on age, location, …

How to Get Affordable Health Insurance Plans

Last modified on August 13th, 2024

Did you know that out of the 27.5 million uninsured Americans, most say they’re uninsured because there are not enough affordable options? Although many are eligible for financial assistance, navigating through finding the right plan is time-consuming, overwhelming, and expensive. These factors play into why so many Americans decide to go uninsured despite the fact that …

How much does individual and family health insurance cost per month?

Last modified on April 15th, 2025

Health insurance is an essential safety net, much like car insurance, to protect against unexpected medical health expenses. While not mandatory everywhere, having health insurance plans ensures financial security and access to affordable healthcare when needed. According to Howard Yeh, CEO of HealthCare.com, health insurance provides peace of mind, enabling people to seek medical care …

Last modified on August 13th, 2024

Historic gains in health insurance coverage have made it easier than ever for low-income individuals to access medical care. Despite these changes in America’s healthcare system, however, more than 27 million individuals remain uninsured. Essential healthcare needs like childhood immunizations and routine check-ups are the first thing to go. Some individuals will also forego certain prescription medications …

Is Short Term Health Insurance Right for You?

Last modified on August 13th, 2024

Considering your health insurance options? Short Term Health Insurance might just be the game-changer you need. In this guide, we’ll break down the nitty-gritty of Limited-duration insurance, helping you evaluate if it’s the right fit for you. No complex jargon, just straightforward information tailored for you. What is a short term health insurance plan? Short-Term …