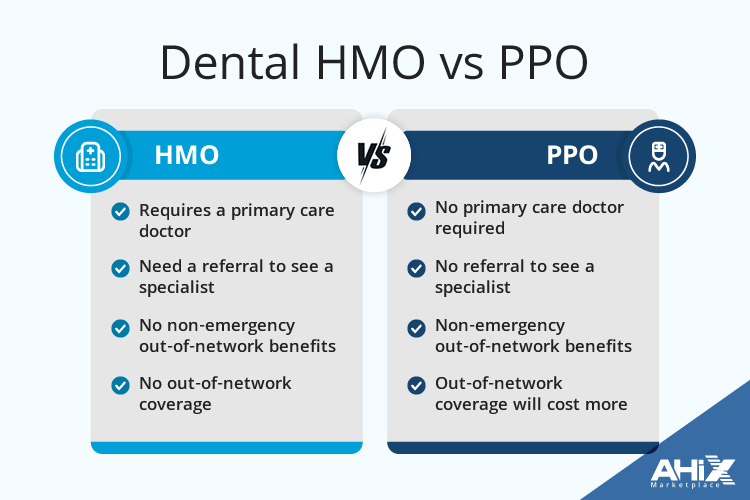

Are you wondering what the real difference between Dental HMO vs PPO plans is? Whether you’re comparing DHMO vs PPO dental insurance for cost, coverage, or provider choice, this guide will help you understand the key differences so you can choose the best dental plan for your budget and needs.

Key Takeaways

- DHMO plans offer lower premiums and predictable costs but require members to select a primary care dentist from a limited network, restricting provider choice.

- PPO dental insurance plans provide greater flexibility by allowing members to see any licensed dentist without referrals, yet generally come with higher premiums and out-of-pocket costs.

- Choosing the appropriate dental plan involves assessing personal dental care needs, costs, coverage, and the provider network to find the best fit for individual circumstances.

Understanding Dental HMO Plans

Dental HMO plans, also known as managed care plans or DHMO, are designed to provide affordable dental care through a network of in-network dentists. These health maintenance organization plans, characterized by affordable premiums and copayments, are structured to encourage regular dental check-ups and preventive care.

However, members must choose a primary care dentist within the HMO’s network, limiting their dentist choice to a predefined list of providers.

How Dental HMO Plans Work

In a dental HMO, the primary care dentist acts as the ‘gatekeeper’ for all your dental care needs. You must select a primary care dentist from the HMO’s network who will manage your routine care and provide referrals if specialist care is needed. This system is designed to streamline care and control costs, but it also means you must stay within the network for all services.

When you need specialist care, such as orthodontics or oral surgery, your primary care dentist will refer you to a specialist within the network. Without this referral, the HMO plan won’t cover the specialist services. This structured approach ensures that patients receive coordinated care but can be restrictive if you prefer more autonomy in choosing your dental providers.

Benefits of Dental HMO Plans

One of the most significant benefits of Dental HMO plans is their cost-effectiveness. These plans typically offer low-cost premiums, averaging around $14 per month, making them an attractive option for budget-conscious individuals. Additionally, they often charge flat copays for services, which helps in making out-of-pocket costs predictable. Preventive care services, such as cleanings and exams, are usually covered in full, promoting regular dental visits.

Dental HMO plans also cover common dental services like fillings, crowns, and implants, with specific copays that make these services affordable. For example, a common copay for fillings under an HMO plan is around $28. This comprehensive coverage at predictable costs makes HMO coverage a practical choice for many.

Limitations of Dental HMO Plans

Despite their affordability, Dental HMO coverage comes with several limitations. Members must choose a primary care dentist from a limited network and do not have coverage for out-of-network services. This restriction can be a significant drawback if your preferred dentist is not part of the HMO’s network. Additionally, certain services like teeth whitening or upgrades to high-end restorations are typically not covered.

Access to specific specialists can also be challenging under a Network-based dental plan, especially for complicated cases that require specialized care. While these plans have lower premiums, the trade-offs in terms of network limitations and service exclusions need careful consideration.

Exploring PPO Dental Insurance Plans

PPO dental insurance plans or Preferred Provider Organization plans, dominate the commercial dental market, making up 86% of it. These PPO insurance plans offer greater flexibility in choosing dentists and do not require referrals for specialist care. A PPO dental insurance plan provides these benefits effectively.

However, they generally come with higher premiums, higher deductibles, and annual coverage limits.

How Preferred Provider Organization Dental Insurance Plans Work

PPO dental insurance coverage plans provide a wider selection of providers, allowing members to see any licensed dentist without needing a referral. This flexibility means you can visit any dentist, whether they are in-network or out-of-network, although using out-of-network providers may result in higher out-of-pocket costs. Services typically covered under PPO plans include preventive care, fillings, crowns, root canals, and treatments for gum disease.

Preventive care is generally covered at 100% under the PPO plan, encouraging regular dental visits and maintenance. However, the broader provider choice and lack of referral requirements come at a cost, as PPO plans usually have higher premiums compared to In-network dental services.

Benefits of PPO Dental Insurance Plan

The primary benefit of PPO dental insurance plans is the flexibility they offer in choosing healthcare providers. Unlike DHMO plans, DPPO plans allow you to see dentists outside the network without needing referrals, and you can switch providers at any time. This flexibility can lead to greater patient satisfaction as it grants more control over one’s dental care.

Additionally, PPO plans provide a broader choice of dentists and specialists, accommodating various patient preferences and needs. This can be particularly beneficial if you have specific provider preferences or require specialized dental services that are not readily available within a limited network.

Limitations of PPO Dental Insurance Plans

PPO dental insurance coverage generally comes with higher premiums than prepaid dental plans. This is largely because PPO plans pay for experienced dentists, leading to increased insurance costs. While these plans offer greater provider choice, this flexibility often results in higher out-of-pocket costs for services received outside the preferred network.

Similarly to DHMO plans, another limitation is the higher out-of-pocket expenses for out-of-network care, which can add up quickly. While PPO plans provide the benefit of seeing out-of-network dentists, the reduced reimbursement rates can make this an expensive option. Balancing these costs against the benefits of provider flexibility is crucial when considering a PPO plan.

Dental HMO vs PPO Comparison Table

| Feature | Dental HMO (DHMO) | Dental PPO (DPPO) |

|---|---|---|

| Premiums | Lower monthly cost | Higher monthly cost |

| Provider Choice | Limited to in-network only | Any dentist, in or out-of-network |

| Referrals for Specialist | Required | Not required |

| Out-of-Network Care | Not covered | Covered but costs more |

| Copays | Fixed, predictable | Varies, often coinsurance |

| Deductibles | Typically none | Usually required |

| Annual Max Benefits | Often no annual limit | Usually $1,000–$2,000 limit |

| Best For | Budget-focused, predictable costs | Flexibility, wide dentist choice |

| Network Size | Smaller network | Larger network |

Key Differences Between DHMO and PPO Plans?

Understanding the key differences between Dental HMO and PPO plans is essential for making an informed decision. HMO plans are characterized by cheap premiums and predictable costs, while PPO insurance plans offer greater flexibility in provider choice but at a higher cost.

Cost Comparison

HMO plans generally have lower monthly premiums compared to Preferred Provider Organization plans, making them more affordable for many individuals. For example, the typical monthly premium for individual PPO plans is around $35, significantly higher than the average premium for HMO plans. Additionally, Prepaid dental plans often do not have deductibles, whereas PPO plans usually have annual maximum deductibles ranging from $50 to $100.

However, it’s important to understand the policy’s coverage limits and benefits schedule before choosing a dental insurance plan. PPO plans typically have annual maximum coverage limits ranging from $1,000 to $2,000, and they often come with higher out-of-pocket costs. Balancing premium costs against potential out-of-pocket expenses is crucial in plan selection.

Choosing the Right Dental Services Plan for Your Needs

Selecting the right dental insurance plan involves careful consideration of your personal needs and preferences. It’s not just about determining which plan is better overall but about finding the best fit for your specific situation.

Whether it’s the cost-saving benefits of an HMO plan or the flexibility of a PPO plan, understanding your requirements is crucial.

Assessing Your Dental Care Needs

Understanding your current dental health and anticipating future needs are critical steps in choosing the right dental insurance plan. Consider recent dental procedures or ongoing treatments, the frequency of your dental visits, and any potential dental issues that might arise based on your age and lifestyle.

For instance, if you or a family member might need orthodontic care or other specialized services in the near future, a plan that provides broader coverage like a PPO might be more suitable. Chronic health conditions and changes in family health history can also impact future dental care requirements, so it’s important to assess these factors carefully.

Considering Costs and Coverage

When evaluating full dental coverage plans, reviewing the plan’s limits and schedule of benefits is essential. Consider the out-of-pocket costs, including copays, deductibles, and premiums, and balance them against the coverage provided.

Cost-effective premiums might be attractive, but if the plan doesn’t cover the services you need, you could end up paying more out-of-pocket. Conversely, higher premiums might be justified if the coverage includes more extensive services and lower out-of-pocket costs for major procedures.

Evaluating Insurance Company Networks

Confirming whether your preferred dentist is part of the insurance network is essential when evaluating dental plans. This step ensures that you can continue seeing your current insurance company without incurring additional costs.

Checking the provider network is especially important if you have a trusted dentist or require specialist care. If your preferred dentist is not part of the network, it might be worth considering a PPO plan that offers more flexibility in provider choice.

Ensuring your nonnetwork providers are in-network will help avoid unexpected out-of-pocket expenses and maintain continuity of care.

Conclusion

In summary, choosing between Dental HMO and PPO plans depends on your individual needs and preferences. Health maintenance organization plans offer discounted premiums and predictable costs but come with network restrictions and referral requirements. In contrast, DPPO plans provide greater flexibility in choosing providers and accessing specialist care, though this comes with higher premiums and out-of-pocket costs.

Ultimately, the best plan for you is one that aligns with your dental care needs, budget, and personal preferences. By understanding the key differences and evaluating your specific requirements, you can make an informed decision that ensures you receive the dental care you need without unnecessary financial strain.

Frequently Asked Questions

1. What does DHMO vs PPO mean for dental insurance?

When comparing DHMO vs PPO, a DHMO dental plan limits you to dentists in the plan’s network and needs referrals for specialists. A PPO dental plan costs more but lets you see any dentist, even outside the network, without referrals.

2. What are the main differences between Dental HMO and PPO plans?

The main differences between Dental health maintenance organization and Preferred Provider Organization plans lie in cost and provider choice; DHMO plans generally feature lower premiums and are limited to in-network dentists, whereas DPPO plans provide more flexibility in selecting providers but at higher premiums and out-of-pocket expenses.

3. How do Dental HMO plans work?

Dental HMO plans operate by requiring you to choose a primary care dentist who oversees your dental care and coordinates any referrals to specialists within the network. This approach ensures streamlined services but restricts your options to the participating providers.

4. What are the benefits of PPO dental plans?

PPO full dental coverage insurance provides significant benefits such as increased flexibility in choosing healthcare providers and the ability to see out-of-network dentists. However, it comes with higher out-of-pocket expenses. This allows for greater autonomy in managing dental care.

5. Is a PPO dental plan worth it over a DHMO plan?

A PPO dental plan may be worth it if you want freedom to visit any dentist or need specialized care without network limits. A DHMO plan saves money but restricts you to in-network providers.

6. Why might I choose a Dental HMO plan?

Choosing a Dental HMO plan could be beneficial if you seek Budget-friendly premiums and predictable costs, provided you are amenable to the network restrictions and referral requirements.

7. What should I consider when choosing a dental insurance plan?

When choosing a dental insurance plan, it is important to assess your current and anticipated dental care needs, evaluate the costs and coverage options, and confirm that your preferred dentist is included in the plan’s network. This careful consideration will help you select a plan that best fits your requirements.

8. How do I choose between a Dental HMO vs PPO plan?

To choose the best Dental HMO vs PPO plan, think about your budget and how much dentist flexibility you want. If you’re okay with a limited network and want lower costs, a DHMO may work. If you want dentist choice, PPO is better but costs more.