Health insurance is an essential safety net, much like car insurance, to protect against unexpected medical health expenses. While not mandatory everywhere, having health insurance plans ensures financial security and access to affordable healthcare when needed.

According to Howard Yeh, CEO of HealthCare.com, health insurance provides peace of mind, enabling people to seek medical care without worrying about high out-of-pocket costs. Although premiums might seem overwhelming, understanding factors that affect health insurance costs helps you choose a plan suited to your budget, ensuring both protection and affordability for you and your family.

At AHiX, we know that understanding the factors affecting health insurance costs is key to selecting a plan that fits your budget and needs. Below are the key elements that determine how much you might pay each month for health insurance.

What is the Average Health Insurance Cost?

The average cost of health insurance varies based on numerous factors, making it challenging to pinpoint a single figure. However, understanding the general cost can help you make informed decisions.

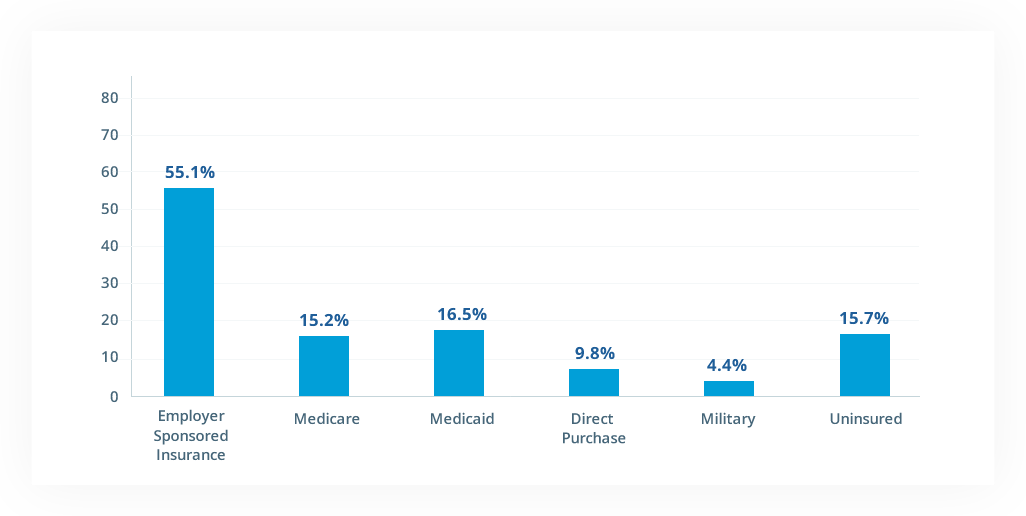

Over 55% of Americans rely on employer-sponsored health insurance. For such plans, the average cost for individual health insurance is approximately $440 per month, while family coverage averages around $1,168 per month.

All qualified plans comply with the Affordable Care Act (ACA) regulations, which mandate coverage for the following the essential health benefits:

- Doctor’s services

- Inpatient and outpatient hospital care

- Prescription drug coverage

-

Pregnancy and childbirth

-

Mental health services

- Sometimes more services

While AHiX services are all valuable, health insurance prices can still become a financial burden for many. To mitigate costs, individuals may turn to alternatives such as Medicare, Medicaid, or non-ACA-compliant plans.

Before exploring your health insurance options, it’s essential to understand the key factors that impact your premiums.

Factor #1: Age

Younger people usually pay less for health insurance than older adults. This is because older adults are more likely to have ongoing health issues and need more medical health care. On the other hand, younger individuals are healthier and don’t visit the doctor as often, so they tend to pay lower premiums.

Factor #2: Location

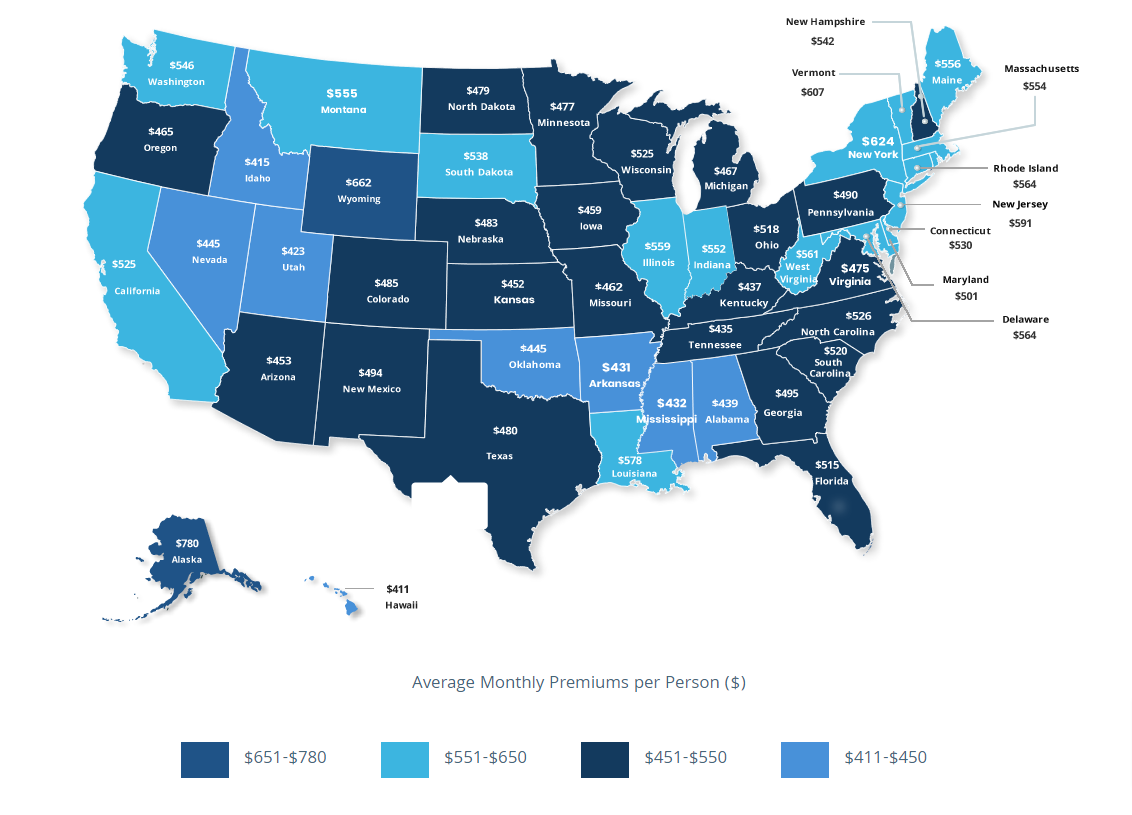

Your location affects how much you pay for health insurance. In states with a higher cost of living, premiums tend to be higher. For instance, Wyoming is reported to have the highest average cost, whereas southern states like Kentucky, Alabama, Mississippi, and more have a lower average cost:

For example, Wyoming has some of the highest costs, while Southern states like Kentucky, Alabama, and Mississippi typically have lower costs. Some states, like California and New Jersey, require residents to have normal health insurance coverage, while others are considering similar rules. Insurers also take regional medical costs into account, which influences how much you pay. These states include:

- California

- Washington, D.C.

- New Jersey

- Vermont

States such as Washington, Oregon, and Maryland are considering similar mandates. Additionally, insurers factor in regional medical costs when setting rates, further impacting premiums.

Factor #3: Tobacco Use

Tobacco usage is another critical factor in determining health insurance costs. Since tobacco use is associated with increased health risks such as heart disease and cancer insurers may charge tobacco users up to 50% more than non-users.

If you are a tobacco user, consider exploring cessation programs to reduce your health insurance premiums and improve your overall health.

Factor #4: Individual or Family Plans

The cost of health insurance also depends on whether you’re purchasing an individual insurance plan or a family health plan. On average:

- Individual plans cost about $440 per month.

- Family plans cost approximately $1,168 per month.

Family plans cover not just the policyholder but also their spouse and dependents, which accounts for the higher premium. Married couples can choose between individual plans or family plans based on their needs and budget. In some cases, separate individual plans may save money compared to a combined family plan.

How Does Gender Affect Health Insurance Costs?

In AHiX, the ACA, gender does not affect low cost health insurance costs. However, with non-qualified health plans, gender can influence premiums. Generally, men tend to pay lower premiums than women. This is because women typically visit doctors more often, use prescriptions, and are at higher risk for chronic conditions. These factors contribute to slightly higher health coverage costs for women compared to men.

Factor #5: Plan Category

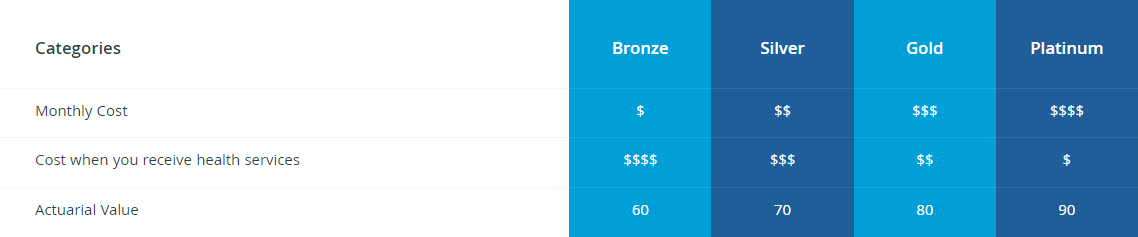

When selecting health insurance, your plan type is based on a “metal” system: Platinum, Gold, Silver, and Bronze. These plans differ in premiums and health coverage. There are also Catastrophic options for those in need of emergency coverage.

Actuarial Value is the percentage of average total costs for covered health services that a plan will cover.

Tier #1: Platinum

The highest premiums, where insurance covers 90% of healthcare costs, and you pay 10%. Ideal for those with frequent doctor visits or ongoing medication.

Tier #2: Gold

With medium premiums, this plan covers 80% of healthcare costs, leaving you to pay 20%. It’s great for those who want to lower monthly premiums while keeping out-of-pocket costs moderate.

Tier #3: Silver

This plan covers 70% of costs with 30% out-of-pocket. Silver plans offer low-to-medium premiums and might qualify you for subsidies based on income.

Tier #4: Bronze

A cheaper option with lower premiums, but higher costs when you need care. Insurance covers only 60%, and you pay 40%. It works best for those who don’t need regular medical services.

Tier #5: Catastrophic

For those who can’t afford traditional plans, Catastrophic insurance offers coverage in emergencies only. It’s available for individuals under 30 or those with a hardship exemption application to see if you qualify.

Conclusion

When considering health insurance for yourself and your family, it’s essential to understand the key factors that affect your health insurance costs. These include age, location, tobacco usage, plan type, and plan category. Each of these elements can influence how much you will pay for your monthly premium.

For example, older adults usually pay higher premiums, and those living in areas with a higher cost of living may face increased rates. Similarly, your health coverage cost will vary depending on whether you choose a Platinum, Gold, Silver, or Bronze plan.

While ACA-compliant plans are a common option, there are also non-ACA health plans available. These may not meet all the ACA requirements but could offer more affordable rates with sufficient coverage based on your needs. Understanding these factors can help you choose the best health insurance option for your budget and lifestyle. Explore health insurance options at AHiX Marketplace to find a plan that works for you. For more details, visit AHiX to compare health insurance plans and get started today.

FAQs

1. How much is the average health insurance cost per month?

The low cost health coverage per month varies depending on factors such as your age, location, coverage level, and the insurance provider. On average, individuals may pay anywhere from $100 to $500 per month for health insurance premiums.

2. How much does health insurance cost for international students in the UK?

Health insurance for international students in the UK generally depends on the provider and insurance coverage plans, with some universities offering affordable plans. Students can also apply for the NHS surcharge to help cover basic healthcare services.

3. What does health insurance costs for a family of 4?

Health insurance for a family of 4 can vary, depending on the coverage options and where you live. Family health insurance plans typically cover a wide range of services, including outpatient care and emergency services.

4. What does health insurance costs in retirement?.

During retirement, health insurance costs can vary. In many cases, retirees may opt for programs like Medicare in the US, with additional coverage available if needed.

5. Can health insurance costs be deducted from taxes?

Yes, health insurance premiums may be tax-deductible under certain circumstances, like being self-employed or meeting medical expense thresholds. This can help reduce your taxable income.

6. What does health insurance cost for the self-employed?

Self-employed individuals typically pay a monthly premium for health insurance, depending on the plan and coverage. In addition, they may be able to deduct these premiums as a business expense to reduce taxable income.

7. How much does health insurance cost without a job?

If you are unemployed, health insurance costs may vary based on your eligibility for government programs like Medicaid, or if you buy insurance through a marketplace like ACA.

8. Does location affect my health insurance premiums?

Yes, premiums can vary significantly based on where you live, with higher costs in states like California and New Jersey.

9. Does health insurance cost more as I get older?

Yes, health insurance premiums generally increase with age, as older individuals tend to need more medical care. AHiX offers insights into how to manage these increased costs and find affordable options based on your age and health needs.

10. Can I save money on health insurance premiums if I’m a non-smoker?

Yes, non-smokers typically pay lower premiums compared to smokers, as tobacco use is associated with higher health risks. If you’re a non-smoker, you may qualify for discounts. AHiX provides options that reward healthier lifestyle choices like not smoking.