In today’s world, having health insurance for your family is very important. Family health insurance plans help cover medical costs and make sure everyone gets the care they need. This blog will explain why you should buy health insurance for your family, how to choose the right and affordable plan, what it covers, and the benefits family health plans provide.

What is Family Health Insurance?

Family health insurance plan is a type of coverage that protects multiple family members under one policy. This means you don’t need separate insurance for each person, making it easier to manage and often cheaper.

Why Should You Buy Family Health Insurance?

1. Financial Protection

Medical expenses can be very high, especially in emergencies. It helps pay these costs, so you won’t have to worry about huge bills.

2. Access to Good Healthcare

With health insurance for your family, you can see doctors and specialists without trouble. You can find the best family health plan that fits your needs at AHiX.

3. Encourages Preventive Care

Many family health plans offer access to over 70 preventive care services for both adults and children, all at no additional cost. . Yes, these services are completely free, which include regular check-ups, vaccinations, screenings, and more.

4. Convenience

Managing one family insurance plan is easier than handling multiple policies. This way, you can focus on your family’s health without worrying about paperwork.

5. Better Health Outcomes

Having insurance encourages families to seek medical care when they need it, leading to healthier lives and fewer serious health problems.

How to Choose the Right Family Health Insurance Plan:

Finding the right plan can feel difficult choice, but here are some simple steps to help you:

1. Understand Your Family’s Needs

Think about your family’s health needs. Do any members have ongoing medical issues? How often do you visit doctors?

2. Research Different Plans

Look for family health coverage plans in your state. Websites like AHiX can help you find options, including cheap health insurance plans that fit your budget.

3. Compare Coverage Options

Once you’ve narrowed down your options, take time to compare the coverage. Ensure the plan includes the essential services your family needs, and carefully review the policy for any limitations or exclusions before making a final decision.

4. Get Help If Needed

If you’re confused, talk to an insurance expert. They can help you find the best family insurance plans for your needs. AHiX has experts who can guide you which insurance to select. Just call 800.800.5735 to learn more.

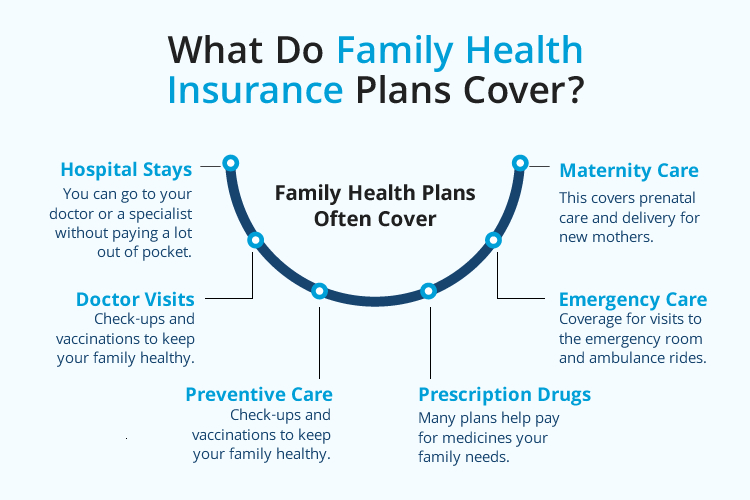

What Do Family Health Insurance Plans Cover?

1. Hospital Stays:

This includes room charges and medical expenses for surgeries.

2. Doctor Visits:

You can go to your doctor or a specialist without paying a lot out of pocket.

3. Preventive Care:

Check-ups and vaccinations to keep your family healthy.

4. Prescription Drugs:

Many plans help pay for medicines your family needs.

5. Emergency Care:

Coverage for visits to the emergency room and ambulance rides.

6. Maternity Care:

This covers prenatal care and delivery for new mothers.

Keep in mind that most plans have a deductible, and depending on your family’s coverage, some services may apply to that deductible before the insurance begins to pay.

Is a Family Health Plan Worth Buying?

In our opinion, yes- investing in a family health insurance plan is the best choice. Here are a few reasons why:

1. Peace of Mind

Knowing your family is covered reduces stress, allowing you to focus on caring for your loved ones without the constant worry of medical bills.

2. Encourages Healthier Families

Families with insurance are more likely to prioritize health by going for regular check-ups, which helps prevent serious conditions.

3. Financial Security

Medical expenses are a leading cause of bankruptcy, with over 60% of personal bankruptcies in the U.S. linked to medical bills. A family health insurance plan protects your savings, ensuring you’re financially prepared for unexpected medical costs.

4. Encourages Healthy Choices

With coverage, families are more likely to seek regular care and adopt healthier lifestyles.

Conclusion

Buying family health insurance is a wise investment for protecting your family’s health and finances. With comprehensive coverage, financial security, and access to quality care, family health plans are crucial for today’s families. Understanding its benefits and features helps you make informed decisions, prioritizing your family’s well-being. Check out AHiX to explore all plans that meet your needs and give you peace of mind.

FAQs

1. What are family health insurance plans?

Family health insurance covers multiple family members under one policy, providing access to important medical services.

2. Is health insurance for families worth it?

In our opinion, Yes Family Insurance Plans are worth it because they offer financial protection, covering doctor visits, hospital stays, and preventive care. It ensures that everyone in your household gets the necessary healthcare without unexpected expenses, making it a smart investment for long-term health and financial security.

3. How do I choose the best health insurance plan for a family?

To choose the best plan, consider factors like coverage options, premiums, deductibles, and the network of healthcare providers. Need help? Call us at 800.800.5735

4. What does a health insurance family plan typically cover?

Over 70 preventive care services, like vaccinations and screenings, are 100% free. Most plans also cover hospital stays, surgeries, routine check-ups, and emergency services, though some services may be subject to a deductible depending on the plan.

5. Are family health insurance plans expensive?

The cost of health insurance plans for families varies based on coverage levels, your location, and the number of family members. However, thanks to subsidies, 4 out of 5 people can get family health insurance for less than $10 per month, making it an affordable option for many families.

6. Can I add more family members to my existing plan?

Yes, most family health plans allow you to add dependents, typically during open enrollment or after qualifying life events.

7. What are the benefits of having family health coverage?

Benefits include comprehensive coverage with access to over 70 free preventive care services, financial protection from unexpected medical costs—a leading cause of bankruptcy and peace of mind knowing you made the right decision for your loved ones.

8. How do I enroll in a family health insurance plan?

You can enroll during open enrollment through health insurance marketplaces, like AHiX, which offer access to multiple carriers in one place. Alternatively, you can enroll directly with individual insurance carriers.

9. Is there a waiting period for coverage?

Some plans may have waiting periods for certain conditions. It’s essential to read the policy details to understand these terms.

10.How can I save money on family health plans?

You can save money by comparing plans, considering high-deductible health plans with Health Savings Accounts (HSAs), and reviewing available subsidies.