If you’re living in South Carolina and need health insurance for a short period of time, temporary health insurance might be the right option for you. This type of coverage is designed for individuals who need insurance for a limited duration, such as those transitioning between jobs or waiting for another policy to begin. While short-term health insurance doesn’t offer the same benefits as a full, ACA-compliant policy, it can still provide essential coverage at a lower cost.

In this blog, we’ll cover everything you need to know about temporary health insurance in South Carolina, including its benefits, coverage options, and costs. We’ll also explain why short-term health plans could be a suitable solution for your needs and how you can secure the best plan through the AHiX Marketplace.

What is Temporary Health Insurance in South Carolina?

South Carolina Temporary Health Insurance, often referred to as short-term medical insurance, is a type of health plan that provides coverage for a short period. These plans typically last anywhere from one month to up to four months. If you’re between jobs or experiencing a gap in your health coverage, temporary health insurance can fill the void.

Unlike standard ACA health plans, Short-term medical plans are not required to cover essential benefits, such as maternity care or prescription medications. However, it does cover basic healthcare needs such as emergency care, doctor visits, and hospital stays.

Temporary health insurance is a budget-friendly option for those who need temporary coverage. The plans offer flexibility in terms of coverage duration and are much cheaper than traditional, long-term health insurance policies. However, it’s important to note that short-term plans are not suitable for everyone, especially those who require comprehensive coverage.

Important Update Starting September 1, 2024

As of September 1, 2024, new regulations limit short-term health insurance plans to a maximum duration of four months, including renewals. If you need coverage for a longer period, it’s essential to enroll during the Open Enrollment Period, which typically runs from November 1st to January 15th each year.

Who Should Consider Short-Term Health Insurance Plans in South Carolina?

South Carolina Short-term Insurance are ideal for those in specific situations where temporary coverage is needed. Here’s who can take advantage of these plans:

1. Starting a new job:

If you’re transitioning between jobs, short-term insurance can fill the coverage gap until your employer’s plan begins.

2. Waiting for a new plan to begin:

When you’re transitioning to a more permanent health insurance plan, a short-term plan offers coverage in the meantime.

3. Without health insurance at the moment:

If you don’t have health insurance due to a life change, such as losing a job, short-term plans can provide an affordable option for coverage.

4. Missed the ACA Open Enrollment deadline:

If you didn’t sign up for ACA health coverage during the Open Enrollment period, you may still be eligible for short-term insurance to ensure you’re covered until the next enrollment window opens.

Short-term health insurance provides flexibility and affordability for individuals in South Carolina who need temporary coverage. Whether you are between jobs, waiting for a new plan, or missed enrollment, these plans are a practical solution for short-term needs.

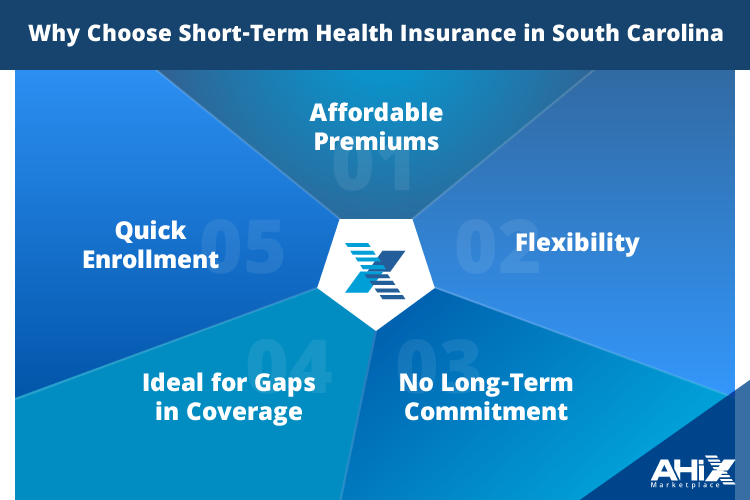

Why Consider Short-Term Health Insurance in South Carolina?

There are several reasons why temporary health insurance might be the ideal solution for your needs in South Carolina. Here are some of the key benefits of short-term health plans:

1. Affordable Premiums

The primary reason many individuals go for short-term health insurance is that it is more affordable compared to full, ACA-compliant health insurance plans. Short-term plans offer a lower monthly premium, which can be very appealing if you’re on a tight budget.

2. Flexibility

Unlike traditional health insurance, temporary health coverage allows you to choose a plan that fits your specific needs. You can select the duration of your coverage based on your situation, whether it’s for a month, three months.

3. Quick Enrollment

Getting enrolled in a short-term health plan is quick and easy. You don’t have to wait for long periods or go through lengthy paperwork. You can apply for coverage and have your plan activated in a short time.

4. Ideal for Gaps in Coverage

If you’re between jobs or waiting for another insurance policy to start, temporary health insurance can fill the coverage gap without requiring you to wait months for coverage to kick in.

5. No Long-Term Commitment

Another major benefit of short-term health insurance is that it doesn’t lock you into long-term commitments. You can cancel the plan whenever you no longer need it, making it a flexible and convenient option.

What Does South Carolina Temporary Health Insurance Cover?

While short-term health insurance is not as comprehensive as ACA-compliant plans, it does provide coverage for essential health services. Here’s what most temporary health insurance plans in South Carolina cover:

1. Emergency care:

If you experience an emergency, temporary health insurance typically covers emergency room visits, ambulance services, and other emergency medical treatments.

2. Hospital stays:

If you’re admitted to a hospital, short-term health insurance can help cover some of the costs associated with your stay.

3. Doctor visits:

These plans generally cover visits to your primary care physician or urgent care center for non-emergency health concerns.

4. Diagnostic tests:

Lab tests, X-rays, and other diagnostic services are often covered by short-term health plans.

However, it’s important to note that temporary health insurance usually doesn’t cover:

1. Preventive care:

Services such as vaccinations, wellness checkups, or cancer screenings.

2. Prescription medications:

Most short-term health insurance plans do not include prescription drug coverage.

3. Mental health care:

Counseling, therapy, and other mental health services are often excluded.

4. Maternity care:

If you’re pregnant or planning a family, temporary health insurance may not cover pregnancy-related services.

Cost of Temporary Health Insurance Coverage in South Carolina

The cost of temporary health insurance can vary depending on several factors, including your age, the duration of the coverage, and the level of benefits you choose. Several factors affect the cost of your temporary health insurance plan:

1. Age:

Older individuals typically face higher premiums because they are at a greater risk for medical issues.

2. Coverage duration:

Longer coverage periods can lead to higher overall premiums, though they often come with lower monthly rates.

3. Level of coverage:

Plans that cover more services will cost more. If you opt for a basic plan with fewer benefits, you can expect to pay less.

Despite these variations, temporary health insurance is still significantly cheaper than a full ACA-compliant health plan, making it a great choice if you’re looking for budget-friendly health insurance.

Things to Know Before Buying Temporary Health Insurance in SC:

While temporary health insurance offers many benefits, it’s important to consider the limitations before purchasing a plan. Here are a few things to keep in mind:

1. Limited Coverage

Short-term health insurance does not cover all the services offered by ACA-compliant plans. If you need more extensive coverage, such as for maternity care, mental health services, or prescription drugs, a short-term plan may not meet your needs.

2. Pre-existing Conditions

Most temporary health insurance plans do not cover pre-existing conditions. If you have an existing medical condition, it’s important to check whether your short-term plan will cover treatments related to that condition.

3. No Renewals

These plans are typically not renewable, so if you need more coverage after the plan expires, you will have to apply for a new short-term health insurance plan.

How to Get the Best Temporary Health Insurance in South Carolina

Finding the Best Temporary Health Insurance Plan for your needs in South Carolina is easy with the AHiX Marketplace. The marketplace offers a variety of plans from different insurance carriers, allowing you to compare options and find the one that best suits your needs.

With AHiX Marketplace, you can:

- Compare different short-term health insurance plans

- Get fast quotes from multiple providers

- Choose the right coverage level for your situation

- Enroll online quickly and easily

Conclusion

Temporary health insurance in South Carolina can be a great option for those who need short-term coverage. It offers lower premiums, flexibility in coverage duration, and quick access to healthcare services. While it may not provide the same level of coverage as traditional health plans, it is an affordable alternative for individuals facing gaps in their insurance.

By exploring short-term health insurance options through the AHiX Marketplace, you can find the right plan to suit your needs at a price you can afford. Whether you’re between jobs, waiting for a new plan, or just need coverage for a short time, temporary health insurance is an excellent choice to consider.

FAQs:

1. What is temporary health insurance in South Carolina?

Temporary health insurance covers you for a short time when you need quick, affordable coverage. It’s ideal for people between jobs or waiting for other coverage.

2. What does temporary health insurance cover in South Carolina?

It typically covers emergency services, hospital stays, and doctor visits. However, it may not include preventive care or prescription drugs.

3. How long can I stay on temporary health insurance in South Carolina?

Plans typically last up to three months, but from September 2024, they will be limited to four months, including renewals.

4. Can I get temporary health insurance if I have a pre-existing condition?

Most temporary health insurance plans do not cover pre-existing conditions.

5. Is South Carolina temporary health insurance the same as ACA health insurance?

No, ACA insurance provides more comprehensive coverage, including maternity and mental health services, while temporary plans offer basic medical coverage.

6. Can I renew temporary health insurance?

No, most temporary health plans are non-renewable, meaning you must apply for a new plan if you need longer coverage.

7. How do I apply for temporary health insurance in South Carolina?

You can apply online through AHiX Marketplace, which offers easy access to multiple insurance options.

8. Is temporary health insurance a good option in South Carolina?

Yes, if you need quick, short-term coverage, it’s affordable and easy to enroll in, though it may not offer all the benefits of long-term plans.