Special Enrollment Periods (SEPs) allow you to sign up for health insurance outside of the regular Open Enrollment period if you experience a major life event — like getting married, having a baby, losing your job, or moving. You typically have 60 days after the qualifying life event (QLE) to enroll. If you miss that window, you may lose your eligibility. In this blog, you will learn which events qualify, what documents may be required to confirm your event, and how to enroll.

Key Takeaways

- Special Enrollment Periods (SEPs) allow you to enroll in health insurance outside of Open Enrollment when you experience a qualifying life event like marriage, birth, or job loss.

- Documentation may be required to confirm your life event, depending on the situation and state rules.

- Most SEPs last 60 days after the event, so timely enrollment and understanding when your coverage starts are key to avoiding gaps in health insurance.

Understanding Special Enrollment Periods

Special Enrollment Periods (SEPs) are designed to be a safety net, offering individuals the opportunity to enroll in health insurance outside the regular annual open enrollment period. These periods are crucial for those who experience significant life changes, including certain life events, ensuring they aren’t left without coverage when they need it most. Unlike the annual open enrollment period, which is available to everyone regardless of their circumstances, SEPs are contingent upon experiencing a qualifying event.

Understanding that SEPs are not just an alternative but a lifeline is crucial. They offer a way to secure health insurance during vulnerable times. Think of it as a special window that opens just for you when life changes dramatically, allowing you to ensure that your health coverage is in place.

With SEPs, the focus is on meeting specific criteria that reflect significant shifts in your life. Understanding these criteria and navigating this window can ensure continuous and adequate health coverage.

Key Life Events That Trigger Special Enrollment

Qualifying life events (QLEs) are significant changes that make you eligible for special enrollment and may help you qualify for a special plan, enabling you to secure health coverage outside the usual annual open enrollment period. But what exactly counts as a qualifying life event?

Marriage is one of the most common QLEs. When you tie the knot, you’re eligible to enroll in a health insurance plan, ensuring that you and your spouse are covered from day one of your new life together. Similarly, the birth or adoption of a child is a monumental event that qualifies you for an SEP. This ensures that your newest family member has health coverage from the start.

Job loss is another significant life event that can trigger an SEP. Losing your job often means losing your health coverage, but a SEP allows you to enroll in a new plan without waiting for the next open enrollment period. Additionally, relocating to a new area, especially a new zip code, or experiencing significant changes in income can make you eligible for a SEP, ensuring that your health coverage aligns with your new circumstances.

Duration of a Special Enrollment Period

Timing is everything when it comes to Special Enrollment Periods. Typically, SEPs last for 60 days after a qualifying life event, providing a limited but crucial window to enroll in a health plan. This means you generally have 60 days before or after the event to secure your health coverage.

However, the specifics can vary depending on certain life events. For instance, the birth or adoption of a child may have different rules regarding the coverage start date compared to other events. Being aware of the enrollment deadlines specific to your qualifying life event ensures timely enrollment and avoids gaps in coverage.

There are also exceptions to the standard rules for coverage effective dates, especially for life events like marriage, adoption, or involuntary loss of coverage. Grasping these nuances can help you navigate your SEP and secure the necessary coverage without delay.

How to Prove Eligibility for Special Enrollment

Eligibility for a Special Enrollment Period sometimes must be proven with documentation. Depending on the nature of your qualifying life event, different types of documents will be needed to verify your eligibility, especially if you’re transitioning from your current plan. For instance, if you recently got married, you may need to provide a marriage certificate to validate the event.

Similarly, the birth or adoption of a child may require a birth certificate or adoption papers. If you’ve moved to a new location, proof of address change, such as utility bills or lease agreements, will be necessary. Other common documents include tax records or government correspondence that can serve as evidence of life changes impacting your health insurance eligibility.

Collecting necessary documents like income proof and eligibility verification streamlines the enrollment process. Being prepared to submit documents ensures a smooth transition into your new health plan, minimizing delays.

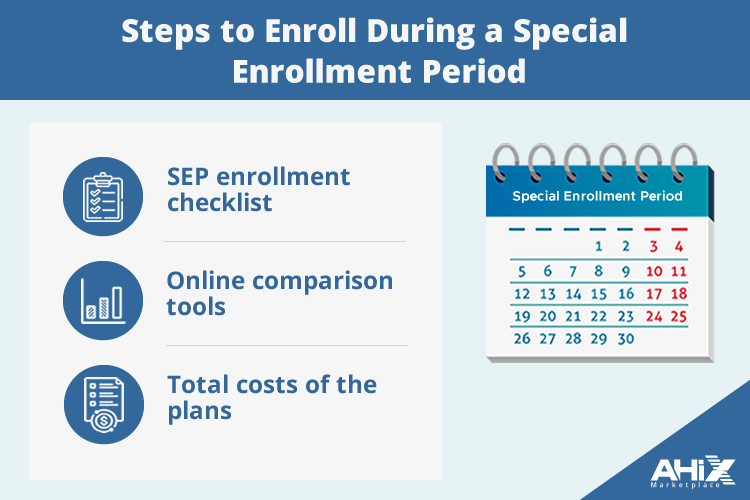

Steps to Enroll During a Special Enrollment Period

To enroll during a Special Enrollment Period, first use the SEP enrollment checklist to prepare. This ensures you have all necessary information and documentation ready.

Next, use online comparison tools to evaluate health plans based on coverage, premiums, and benefits. These tools aid in making an informed decision by comparing plans side-by-side. Also, check if your preferred doctors and hospitals are in-network for the plans you are considering.

Lastly, consider the total costs of the plans, including deductibles, copayments, and out-of-pocket maximums, when deciding. This comprehensive approach will help you select a health plan that fits your healthcare needs and budget.

Coverage Start Dates During Special Enrollment

One of the most critical aspects of enrolling during an SEP is understanding when your coverage will begin. For certain qualifying events, like childbirth, coverage will begin retroactively to the baby’s date of birth.

In cases where you enroll due to losing health coverage, your new plan can start on the first day of the next month. This ensures there is no gap in your health coverage, which is vital for continuous protection.

Other qualifying events may also allow for retroactive coverage, depending on the situation. Being aware of these timelines can help you avoid unexpected gaps and make sure you’re protected when it matters most.

Potential Cost Savings and Financial Assistance

Financial assistance is a significant benefit available during Special Enrollment Periods. This includes premium tax credits and cost-sharing reductions, which can make health coverage more affordable under the Affordable Care Act. For example, in Michigan, approximately 80% of residents could potentially pay $10 or less for a health plan. When shopping for health coverage, most people should always check if they qualify for additional savings, as this can significantly reduce your out-of-pocket costs.

Exploring all available options and understanding the financial assistance programs you may be eligible for are important. This not only makes your health coverage more affordable but also provides necessary support and ensures you have access to the care you need without undue financial strain.

What If You Miss the Special Enrollment Window?

Missing the Special Enrollment Period window doesn’t mean you’re out of options. You can enroll during the next open enrollment period or consider short-term health insurance for temporary coverage until the next open enrollment.

Short-term health insurance can serve as a safety net, but losing coverage from these plans does not qualify you for a SEP for ACA-compliant plans. You can appeal a SEP denial within 90 days if you disagree with the decision.

Knowing these alternatives ensures you have a backup plan, so you’re never without health coverage when you need it most.

Summary

Navigating the complexities of Special Enrollment Periods can seem overwhelming, but understanding the key points can make the process much more manageable. From knowing what qualifies as a life event to the steps needed for enrollment and understanding coverage start dates, each piece of information is crucial for securing the health coverage you need.

Remember, life is full of unexpected changes, and SEPs are there to ensure that these changes don’t leave you without health insurance. Stay informed, stay prepared, and take action when you qualify for a SEP to maintain continuous and adequate health coverage.

Frequently Asked Questions

1. What is a Special Enrollment Period?

A Special Enrollment Period (SEP) enables individuals to enroll in health insurance outside the standard open enrollment timeframe due to qualifying life events, such as marriage or job loss. This provides valuable flexibility for those experiencing significant changes in their circumstances.

2. What are some qualifying life events for a SEP?

Qualifying life events for a SEP include marriage, the birth or adoption of a child, foster care job loss, relocation, and significant changes in income. These events allow individuals to make adjustments to their health insurance coverage.

3. How long does an SEP last?

A Special Enrollment Period (SEP) lasts for 60 days following a qualifying life event, allowing a limited time to enroll in a health plan.

4. What documentation is needed to prove eligibility for an SEP?

To prove eligibility for a Special Enrollment Period (SEP), you typically need documentation like marriage certificates, birth certificates, proof of address change, Medicaid documents, tax documents, or loss of coverage notices.

5. What options are available if I miss the SEP window?

If you miss the SEP window, your options include enrolling during the next open enrollment period or short-term health insurance for temporary coverage.