Arizona Temporary health insurance, also known as short-term health insurance, can be an essential solution for many Arizonans who find themselves without traditional health insurance coverage. Whether you are between jobs, waiting for your employer’s benefits to kick in, or just needing coverage for a short period, understanding temporary insurance is crucial. its benefits, limitations, and how to choose the best plan for your needs.

What is Short-Term health insurance in Arizona?

Short-term health insurance in Arizona is designed to provide coverage for a limited period, usually from a few months up to a year. These plans are meant to be a stopgap measure, offering protection against unexpected medical expenses during transitional times in your life. Unlike traditional health insurance, short-term plans often have more flexible enrollment periods, allowing you to sign up whenever you need option.

Why consider temporary health insurance in Arizona?

There are several scenarios where Arizona temporary health insurance might be the right choice for Arizonans:

- Job Transition: If you are between jobs and waiting for your new employer’s health benefits to begin, a temporary plan can fill the gap.

- Waiting Periods: Some employer-sponsored plans have a waiting period before coverage starts. Temporary insurance ensures you remain covered during this time.

- Missed Open Enrollment: If you missed the open enrollment period for the Health Insurance Marketplace, it will provide coverage until the next enrollment period.

- Recent Graduates: Graduates who are no longer covered under their parent’s plans and are waiting to secure a job can benefit from temporary coverage.

Key Features of Arizona Temporary Health Insurance Plans

Temporary insurance plans offer several key features that make them attractive for short-term coverage:

- Flexibility: Enrollment is not limited to specific periods, allowing you to sign up as needed.

- Affordable Premiums: These plans generally have lower premiums compared to traditional health insurance.

- Quick Coverage: Approval and coverage can begin almost immediately after application.

Limitations of Short-Term Insurance

While Arizona Temporary Insurance offers numerous benefits, it is important to be aware of its limitations:

- Limited Coverage: Temporary plans typically do not cover pre-existing conditions, preventive care, maternity care, or mental health services.

- Maximum Coverage Period: Coverage is limited to a maximum of 12 months, with the possibility of renewal up to 36 months, depending on state regulations.

- Lifetime and Annual Limits: These plans often come with lifetime and annual limits on benefits.

Cost of Temporary Health Insurance in Arizona

The cost of Arizona Temporary health insurance can vary based on several factors:

- Age: Older individuals may face higher premiums.

- Coverage Length: The duration of coverage can affect the overall cost.

- Plan Benefits: Plans with more extensive coverage will generally cost more.

- Deductibles and Copayments: Higher deductibles can lead to lower premiums, while lower deductibles might result in higher premiums.

On average, you might find that Temporary insurance are more affordable than traditional plans. However, it’s essential to balance cost with the level of coverage you need to avoid unexpected out-of-pocket expenses.

Eligibility for Short-Term Health Insurance in Arizona

To be eligible for Short-Term Health Insurance, you generally need to meet the following criteria:

- Age: You must be under 65 years old.

- Residency: You must be a resident of Arizona.

- Health Status: Some plans may require you to pass a health screening or answer questions about your medical history.

Comparing Temporary Insurance Providers

When selecting a temporary insurance plan, it is essential to compare different providers to find the best coverage for your needs. Here are some factors to consider:

- Coverage Options: Ensure that the plan covers essential services that you might need.

- Premiums and Deductibles: Compare the cost of premiums and the amount you will need to pay out-of-pocket before the insurance starts covering expenses.

- Network of Providers: Check if the plan includes your preferred doctors and hospitals.

- Customer Service: Research the provider’s reputation for customer service and ease of claim processing.

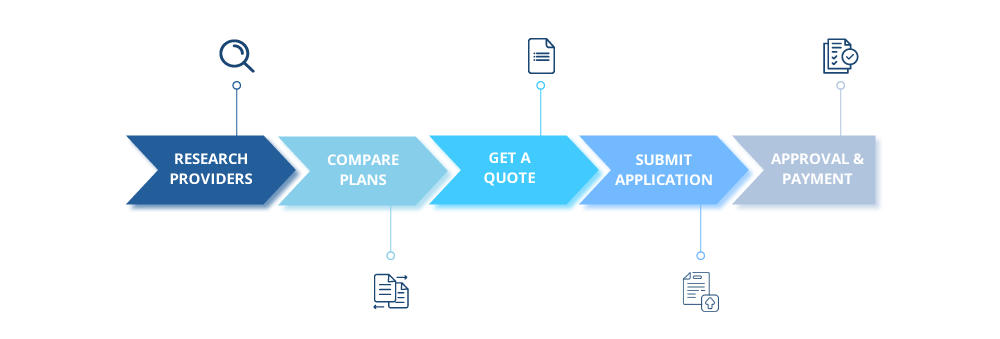

How to Apply for Short-Term Health Insurance in Arizona

Applying for Arizona Short-Term Health Insurance is a straightforward process. Here are the steps to follow:

- Research Providers: Start by researching different insurance providers offering short-term plans in Arizona.

- Compare Plans: Compare the features, benefits, and costs of various plans.

- Get a Quote: Obtain quotes from multiple providers to understand the cost of coverage.

- Submit an Application: Once you have chosen a plan, submit an application either online or over the phone.

- Approval and Payment: Upon approval, pay your first premium to activate the coverage.

Understanding Coverage Terms and Conditions

It is crucial to thoroughly read and understand the terms and conditions of your plan. Pay attention to:

- Exclusions: services and conditions that are not covered by the plan.

- Waiting Periods: Any waiting periods before certain benefits become effective.

- Renewal Options: The ability to renew the plan and any conditions for renewal.

Temporary Health Insurance vs. Traditional Health Insurance

Temporary health insurance and traditional health insurance serve different purposes and have distinct differences:

- Duration: Temporary plans are for short-term coverage, while traditional plans provide long-term coverage.

- Coverage: Traditional plans offer comprehensive coverage, including preventive care, maternity, and mental health services, which are often excluded from temporary plans.

- Cost: Temporary plans generally have lower premiums but higher out-of-pocket costs compared to traditional plans.

Impact of the Affordable Care Act (ACA)

The Affordable Care Act (ACA) has influenced the landscape of health insurance. While ACA-compliant plans must cover pre-existing conditions and essential health benefits, temporary plans are not required to meet these standards. This makes temporary plans less expensive but also less comprehensive.

Financial Assistance for Short-Term Insurance Plan in Arizona

For those who find traditional health insurance unaffordable, there are financial assistance options available:

- Subsidies: The Health Insurance Marketplace offers subsidies based on income, which can make traditional insurance more affordable.

- Medicaid: Low-income individuals and families may qualify for Medicaid, providing comprehensive coverage at little to no cost.

Renewing Your Temporary Insurance Plans

If your need for insurance extends beyond the initial coverage period, you may have the option to renew your plan. However, renewal terms vary by provider, and some may require you to reapply.

Short-Term Insurance Plan for Self-Employed Individuals

Self-employed individuals often face challenges in finding affordable health insurance. These can be a viable solution for those in transition between coverage options or waiting for a more permanent solution.

Is Arizona Short-Term health insurance right for you?

Deciding the right choice depends on your specific circumstances:

- Short-Term Needs: If you only need coverage for a brief period, temporary medical plans might be suitable.

- Budget Constraints: These plans often have lower premiums, making them more affordable in the short term.

- Coverage Requirements: Consider whether the plan covers the services you need. If you require coverage for pre-existing conditions or comprehensive benefits, a traditional plan might be better.

How to Maximize Your Health Insurance Benefits

To get the most out of your Arizona health insurance, consider the following tips:

- Understand Your Plan: Familiarize yourself with the details of your coverage, including exclusions and limits.

- Use In-Network Providers: To minimize out-of-pocket costs, use healthcare providers within your plan’s network.

- Stay Healthy: Preventive care is often not covered, so focus on maintaining a healthy lifestyle to avoid unexpected medical expenses.

Choosing the Right Short-Term Insurance Plan

Selecting the right insurance plan involves careful consideration of your healthcare needs and financial situation. Here are some steps to help you choose:

- Assess Your Needs: Determine the level of coverage you need based on your health and anticipated medical expenses.

- Compare Plans: Look at different plans side by side to see which offers the best balance of cost and coverage.

- Check Exclusions: Make sure you understand what is not covered by the plan to avoid surprises.

Temporary insurance provides a flexible and affordable solution for those in need of short-term coverage. While it may not offer the comprehensive benefits of traditional health insurance, it can be an excellent option during transitional periods. By understanding the features, costs, and limitations of health insurance plans, you can make an informed decision that best suits your needs.

Frequently Asked Questions:

1. Can I cancel my temporary insurance plan anytime?

Yes, most Arizona insurance plans allow you to cancel at any time without penalty. However, you should check the specific terms of your plan.

2. Are prescription drugs covered under temporary insurance?

Coverage for prescription drugs varies by plan. Some temporary plans include prescription drug coverage, while others do not. It’s important to review the details of each plan.

3. What happens if I develop a serious illness while on a temporary insurance plan?

If you develop a serious illness while covered by an Arizona Temporary Insurance Plan, your coverage will continue until the end of the policy term. However, pre-existing conditions may not be covered if you try to renew the plan.

4. Can I apply for Short-Term insurance plans if I am pregnant?

Temporary insurance plans generally do not cover maternity care or pregnancy-related expenses. If you are pregnant, you may need to seek other insurance options.

5. How quickly does temporary insurance coverage start?

Coverage for temporary plans can start as soon as the next day after your application is approved and your premium is paid.

6. Top Providers of Short-Term Insurance in Arizona?

Some of the leading providers of temporary plans in Arizona include:

- AHiX: Offers a wide selection of plans with expert guidance for choosing the right plan.

- UnitedHealthcare: Offers a variety of short-term plans with flexible coverage options.

- National General Accident & Health: Known for affordable premiums and comprehensive coverage.

- Blue Cross Blue Shield of Arizona: Provides extensive network access and robust plan options.

- Pivot Health: Specializes in customizable plans with various coverage levels.

Get covered and stay protected with temporary insurance in Arizona. Explore your options today to find the right plan for your needs.