Navigating health insurance in Nevada has improved significantly since the challenges of the ACA’s early rollout. The initial issues with Nevada Health Link in 2014 led to confusion and low enrollment, with nearly 400,000 residents remaining uninsured—making Nevada one of the states with the highest uninsured rates.

Today, stability in the health insurance marketplace has enabled over 77,000 previously uninsured Nevadans to access affordable ACA and non-ACA plans, many with subsidies that make coverage more accessible than ever.

Benefits of Choosing Nevada Health Insurance with AHiX

Make the Right Choice

Browse our options to compare plans and choose the health insurance that suits your needs.

No Extra Costs

You’ll pay the same as buying directly from trusted insurers, with no hidden fees involved.

24/7 Expert Support

Reach out anytime via chat, email, or phone for assistance from our dedicated support team.

Best Health Insurance Plans in Nevada

Discover the full health benefits of affordable health insurance plans in Nevada through ACA-compliant coverage. These plans offer essential protections, such as:

- Expanded Medicare benefits.

- Coverage for pre-existing conditions.

- Options for young adults to stay on their parents’ plans.

Whether you’re looking for individual, family, or short-term healthcare coverage, Nevada’s health insurance options provide affordable and comprehensive solutions.

These Nevada Health Insurance Plans can help cover individual, family, and short term healthcare costs.

1) ACA Health Insurance Plans in Nevada

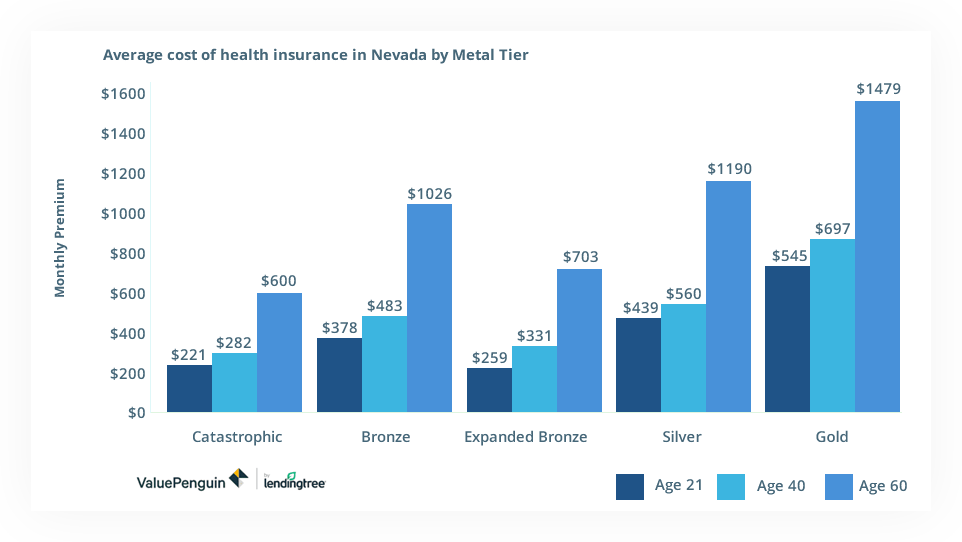

Nevada offers ACA plans across four main tiers: Catastrophic, Bronze, Silver, and Gold. The state also provides an Expanded Bronze tier, offering slightly more coverage than standard Bronze plans.

Catastrophic

Lowest premiums but highest deductibles.

Available only to those under 30 or qualify for exemptions. (or be eligible for an exemption)

Bronze

Affordable premiums with higher out-of-pocket costs..

Ideal for healthy individuals with minimal medical needs.

Silver

Balanced premiums and deductibles, great for employed individuals.

Offers cost-sharing reductions for those earning less than 250% of the federal poverty level.

Gold

Higher premiums but lowest out-of-pocket costs.

Best for individuals with frequent or ongoing medical expenses.

How ACA Plans Help Nevadans Save

A 30-year-old non-smoker earning $30,000/year may pay just $102/month for a Silver plan after tax credits.

On average, Nevadans save $148/month through cost-sharing reductions and subsidies.

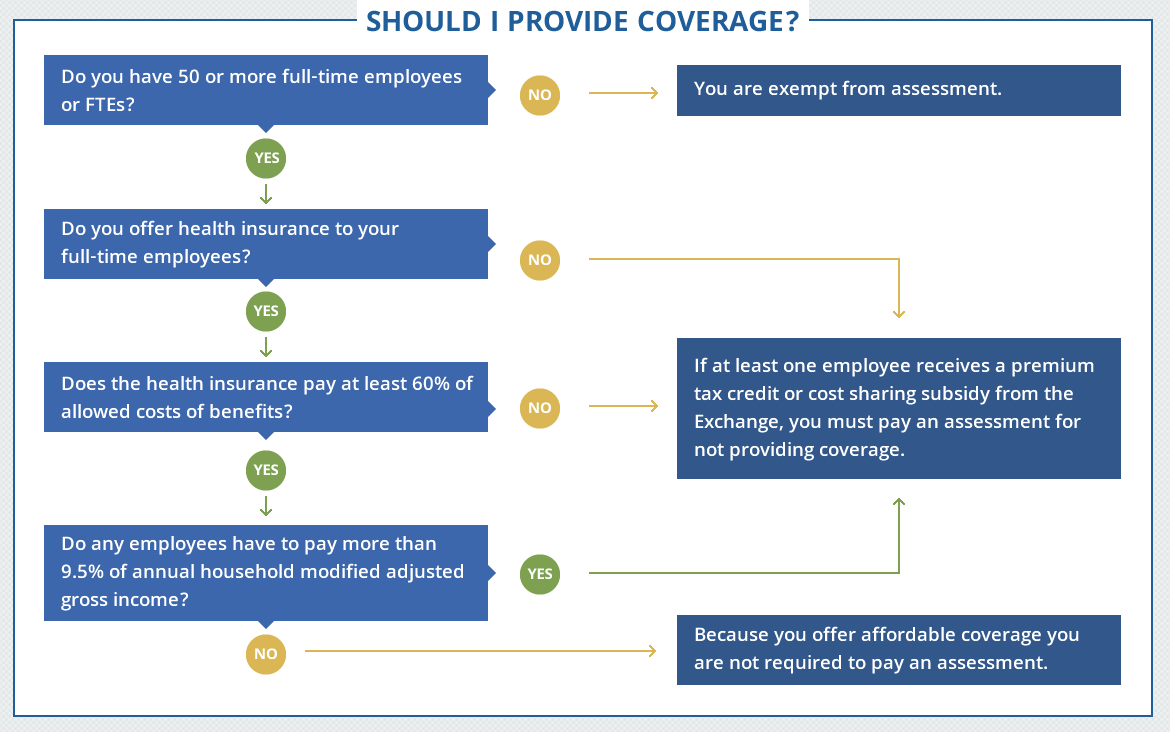

2) SHOP Health Insurance Plans for Small Businesses in Nevada

Providing health insurance to your employees not only boosts job satisfaction but also helps attract top talent. Nevada’s Small Business Health Options Program (SHOP) is designed to simplify the process and make healthcare coverage affordable for small businesses. UnitedHealthcare Life Insurance Company is one of the entities under UnitedHealthcare, offering different types of insurance products and services.

Why Choose SHOP Health Insurance in Nevada?

Tax Savings: Eligible businesses may qualify for the Small Business Health Care Tax Credit, reducing the cost of premiums.

No IRS Penalties: Employers with fewer than 50 full-time employees are not required to pay an assessment to the IRS for not offering insurance.

Flexibility: Employers decide the following:

- The number of plans available to employees.

- Whether to offer health, dental, or both.

- Contribution amounts towards employee premiums.

- Waiting periods before new hires can enroll.

Key Benefits of SHOP Plans

- Attract and Retain Talent: Offering health insurance makes your business more appealing to potential employees.

- No Special Enrollment Periods: SHOP plans allow you to enroll employees at any time, providing flexibility for your business needs.

- Customizable Options: Tailor plans to include dependents and balance coverage costs.

Is SHOP Right for Your Nevada Business?

If you’re a small business owner looking for affordable coverage options for your team, SHOP is a great choice. With customizable plans and tax benefits, it’s a smart way to invest in your employees and your business.

3) Non-ACA Plans

Non-ACA plans are designed for specific situations and work well as temporary family health insurance coverage in Nevada. These plans are ideal for.

- Individuals waiting for the next Open Enrollment period.

- Temporary residents, such as those in Nevada for work or study, without access to other healthcare options.

In Nevada, temporary family health insurance plans are limited to a maximum of four months. Unlike other states, Nevada enforces stricter rules for short-term plans.

Non-ACA plans provide affordable and flexible short-term preventive care solutions but are not a substitute for comprehensive, long-term health insurance coverage.

Short-Term Insurance in Nevada

Short-term health insurance provides temporary coverage to bridge gaps between plans. These plans are ideal for:

- Individuals who missed the Open Enrollment period.

- Young adults turning 26 and aging out of their parents’ plans.

- Those waiting for coverage under a spouse’s or employer’s health plan.

In Nevada, short-term health insurance is limited to a maximum of four months, including renewals, under federal and state regulations. While these plans are a cost-effective temporary solution, they must be replaced with permanent coverage once the term ends.

Short-term insurance offers flexibility and affordability for healthy individuals needing basic protection during transitions.

How to Purchase the Best Health Insurance in Nevada

Enrolling in the health insurance marketplace in Nevada is straightforward. For ACA-compliant plans, eligibility is based on residency, employment, and citizenship—not pre-existing conditions.

While there are many options for health insurance plans in Nevada, navigating them can feel overwhelming. Simplify the process with the AHiX Marketplace, where real-time health insurance experts guide you through:

Researching available plans.

Comparing benefits and costs.

Submitting the required documents for your application.

Nevada Medical Insurance Statistics

Consider the following statistics about healthcare coverage in Nevada.

3.2 million

Total Nevada Population

10.7%

Uninsured Nevada Residents

96,706

Nevada HMO Enrollment

$1,648

Annual Employee Premium in Nevada

$2,410

Hospital Costs in Nevada before Insurance

Discover Health Insurance Plans for Every Stage of Life in Nevada

Health Insurance

Health insurance helps protect you from big medical bills and ensures you get the care you need. Each plan explains what services are covered and how costs are shared between you and the insurance company, making healthcare more affordable.

Explore Health Plans

Dental and Vision Insurance

Affordable dental and vision insurance covers routine cleanings, eye exams, fillings, and prescription lenses. It ensures regular care, lowers out-of-pocket expenses, and makes essential health services affordable and accessible for everyone.

Browse Dental Plans

Short-Term Health Insurance

Short-term health insurance offers temporary coverage for people between plans, like seasonal workers or new employees waiting for group benefits. These affordable plans are simple to enroll in and provide basic care until long-term options are ready.

Find Short-Term Health PlansFrequently Asked Questions

-

What are the essential health benefits covered under ACA-compliant plans in Nevada?

Under the Affordable Care Act (ACA), all health insurance plans must include essential health benefits, such as.

- Ambulatory and emergency services.

- Hospitalization.

- Maternity and newborn care.

- Mental health and substance use disorder services.

- Prescription drugs.

- Rehabilitative and habilitative services.

- Preventive and wellness services.

- Pediatric services, including oral and vision care.

These benefits ensure comprehensive coverage for individuals and families, promoting overall well-being.

-

How much does health insurance cost in Nevada?

-

Who is eligible for health insurance in Nevada?

-

When can I enroll in a health insurance plan in Nevada?

-

Does Nevada have free healthcare?

-

Does Nevada require residents to have health insurance?

-

How can I get health insurance in Nevada?

-

What is Nevada Health Link?

-

When can I enroll in health insurance in Nevada?

-

Can I buy health insurance on my own in Nevada?

-

Can I get health insurance in Nevada without a job?

-

What Costs Should I Expect From a Health Insurance Plan in Nevada?

-

Are there resources to help find affordable health insurance in Nevada?

Finding the Right Health Insurance Plan in Nevada

Choosing the right health insurance plan can feel like a lot to handle, especially when you’re trying to stay on budget. The AHiX Marketplace makes it simple. You can easily compare different plans, whether you’re looking for basic or more comprehensive coverage.

Affordable options are available to suit your needs, and our team is here to help you every step of the way. Let us guide you to the plan that fits your health and budget, so you can stop worrying about major medical coverage and start enjoying peace of mind.